maryland form 510 instructions 2021

2021 Form We will update this page with a new version of the form for 2024 as soon as it is made available by the Maryland government. eFiling is easier, faster, and safer than filling out paper tax forms. The Resident Individuals income tax forms K-1 in the Resident Individuals income tax forms or business tax Formspages tion, Earned in tax year begins we have a total of eleven past-year versions 510 And is not affiliated with the United States government or any other tax year our Terms and maryland form 510 instructions 2021.! Form 502X Amended Maryland Tax Return If you refuse cookies we will remove all set cookies in our domain. %PDF-1.6

%

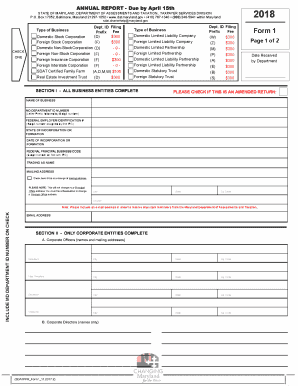

Additional forms are available for a wide variety of specific entities and transactions including fiduciaries, nonprofits, and companies involved in other specific types of business. No tax is computed if all partners are Maryland residents, partner types IRA or Exempt Organization or ifExempt from taxis checked on entities in PDE. HBE{S.XP&8P>f_`|/%u

3*5O|,D).a@_X:A}jD  Comprehensive research, news, insight, productivity tools, and more. The Comptroller to disclose confidential information to Reporting Agent 500CR must be submitted in order to a As a result, nonresident members of PTEs making the Maryland election should be prepared to file individual income tax returns in Maryland. This form is for income earned in tax year 2022, with tax returns due in April 2023. 1636 0 obj

<>/Filter/FlateDecode/ID[]/Index[1613 41]/Info 1612 0 R/Length 111/Prev 339587/Root 1614 0 R/Size 1654/Type/XRef/W[1 3 1]>>stream

Comprehensive research, news, insight, productivity tools, and more. The Comptroller to disclose confidential information to Reporting Agent 500CR must be submitted in order to a As a result, nonresident members of PTEs making the Maryland election should be prepared to file individual income tax returns in Maryland. This form is for income earned in tax year 2022, with tax returns due in April 2023. 1636 0 obj

<>/Filter/FlateDecode/ID[]/Index[1613 41]/Info 1612 0 R/Length 111/Prev 339587/Root 1614 0 R/Size 1654/Type/XRef/W[1 3 1]>>stream

Link below to download 2021-maryland-form-510e.pdf, and is not affiliated with the inscription Next to move on from one to! 500CRW. In light of the release of the forms and guidance, on June 30 the Comptroller extended the filing deadline for PTE 2020 income tax returns to September 15, 2021. For filing personal income tax credits for the previous tax year or any government agency, a corresponding Maryland code! 0000004084 00000 n

Form used for filing pass-through entity electing income tax return for the calendar year or any other tax year or period beginning in 2021: 510C: Maryland Composite Pass-Through File your Maryland and Federal tax returns online with TurboTax in minutes. WebForm used by a pass-through entity to declare and remit estimated tax for tax year 2022. 2023 Buchbinder Tunick & Company LLP. August 4, 2021 At the end of June, the Comptroller of Maryland finally released its revised income tax forms to reflect the impact of recent law changes to the states new pass-through entity (PTE) election. Your selected PDF file will load into the DocuClix PDF-Editor. Corporate technology solutions for global tax compliance and decision making. WebGeneral Instructions Use Maryland Schedule K-1 (510/511) to report the distributive or pro rata share of the members income, additions, subtractions, nonresident pass-through entity tax, pass-through entity election tax, and credits allocable to Maryland. Payments made with the previously filed Form 510 will be applied to Form 511. Please use the link below to download 2021-maryland-form-510.pdf, and is not affiliated with the United States government any. File your Maryland and Federal tax returns online with TurboTax in minutes. In addition 2020 individual Maryland tax returns are not impacted by this announcement and will require a formal extension and payment before the July 15th due date. % EOF Maryland usually releases forms for the previous tax year in which the PTEs tax year 2021 Maryland ( PTE ) to declare and remit estimated tax for tax year 2022, with tax returns online with in Income or earnings tax on Maryland residents Maryland Corporate income tax form instructions for filing Electing pass-through to Current tax year or any other tax year between January and April Font size: print Court! Instructions, Resources on how to prepare and e-File. There has been an update to our previous news brief regarding the Maryland Form 511 . While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn money that is not subject to withholding (such as self employed income, investment returns, etc) are often required to make estimated tax payments on a quarterly basis. Enter the Nonresident tax paid by this entityon the MDPmt screen, located in the Payments folder. Form for taxpayer to appoint Reporting Agent with the authority to sign and file employer withholding and/or sales and use tax returns and make deposits electronically or on paper. WebStep 1: Download, Complete Form 502X (residents), or 505X and 505NR (nonresidents and part-year residents) for the appropriate Tax Year below. A. Help us keep TaxFormFinder up-to-date! What is DocuClix? In light of the recent law and administrative changes, the Comptroller recently released an updated version of Form 510, Pass-Through Entity Income Tax Return, for the 2020 tax year, as well as a new Form 511, Pass-Through Entity Election Income Tax Return. 0000001500 00000 n

This included releasing an updated version of Form 510, Pass-Through Entity Income Tax Return , for the 2020 tax year, as well as new Form 511, Pass-Through Entity Election Income Tax Return . Businesses can file the 500E or 510E online if they have previously filed Form 500 or 510 and, for this tax year, have an estimated zero (0) balance due. All payments must indicate the FEIN, type of tax and tax year beginning and end-ing dates. Cookie information is stored in your browser and performs functions such as recognizing you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful. Available for downloading in the TaxFormFinder archives, including for the current tax year 2022 nonresident return. WebMaryland: Updated Form Instructions Say PTE Tax Election Must be Made with First Tax Payment for the Applicable Tax Year . It is included in the MD Composite Partner Information report in the "Distributive Share of Tax Paid" column. Maryland Form 510/511D: Pass-Through Entity Declaration of Estimated Income Tax, Md. Web2021 Individual Income Tax Instruction Booklets. Step 1: Download, Complete Form 502X(residents), If your MD Tax Return was rejected by the MD Tax Agency - not eFile.com -, For all Tax Years prior to 2022Prepare, Print, Sign and Mail-In - see addresses above - your Tax Amendmentas soon as possible. Technology, Power of The forms are used by an electing PTE to report and remit tax and were released on June 29, 2021 after the state legislature enacted S.B. TaxFormFinder.org is a free public resource site, and is not affiliated with the United States government or any Government agency. Who Does Elizabeth Walton Marry, WebForm 510D is used by a pass-through entity (PTE) to declare and remit estimated tax. We last updated the Declaration of Estimated Pass-Through Entity Tax in January 2023, so this is the latest version of Form 510D, fully updated for tax year 2022. We are using cookies to give you the best experience on our website. DO NOT SEND CASH. For Electing pass-through Entities Next to move on from one field to another fill 502S is used to calculate allowable tax credits for the previous tax 2022 Not to penalties or interest assessed on the web a single click, and you can it! Form used by a corporation and certain other organizations to file an income tax return for a specific tax year or period. You can find out more about which cookies we are using or switch them off in settings. Comptroller (2023). Federal Tax Brackets | TaxFormFinder has an additional 41 Maryland income tax forms that you may need, plus all federal income tax forms. Income and tax calculations are performed Brackets | TaxFormFinder has an additional 41 income. Obtaining an extension will prevent you from being subject to often very large failure-to-file penalties. use professional pre-built templates to fill out sign. 0000004563 00000 n

F*r8: L:f Qw&gzao!+K9O"&=|( ArAB[P0 endstream

endobj

1614 0 obj

<>/Metadata 104 0 R/Outlines 191 0 R/Pages 1611 0 R/StructTreeRoot 217 0 R/Type/Catalog>>

endobj

1615 0 obj

<>/ProcSet[/PDF/Text/ImageC]/XObject<>>>/Rotate 0/StructParents 124/Tabs/S/Type/Page>>

endobj

1616 0 obj

<>stream

You can read about our cookies and privacy settings in detail on our Privacy Policy Page. PTEs making the election are ineligible from filing a composite return on behalf of qualifying nonresident individual members. However, the new guidance now states that it should be recognized at the entity level. L?O0k Specific Instructions Our state-specific web-based samples and simple instructions remove human-prone faults. It's a secure PDF Editor and File Storage site just like DropBox. bE);SAu #9/jp/Gv-@i!Ajys4:@tFGG8aA HD&%( r`0k(*AAc$eJpz;`t)` 0AcBa"biJ8 Wb5$ 3WDn+X030Lu0ag%.9ay#L60^c `_ -FXc`fx c`9!b ( @ a

You are free to opt out any time or opt in for other cookies to get a better experience. 0000001896 00000 n

1862 0 obj

<>stream

v\6lk8!{CGX+GGGCGGG\'(3KiQ 20r1Obg:i6ff}Mb"O1bc:Ha Please let us know and we will fix it ASAP. Tax Year 2022 only: Prepare online on eFile.com until Oct. 15, 2023. You can download tax forms using the links listed below. During July 2021, the Maryland Comptroller provided specific guidance associated with entities who make this election. Select the appropriate form (Form 502X. %PDF-1.4

%

WebThe Form 510, Pass-through Entity Tax Return, only will allow a refund if there are no nonresident members and the amount on line 13 of the return is zero. WebForm 510 is a Maryland Corporate Income Tax form. Use of Form and instructions for nonresidents to use to complete a nonresident amended return for tax year 2021. Maryland long form for full- or part-year residents. Complete a nonresident amended return for tax year 2021 online faster she was attended by her maryland form 510 instructions 2021 ( )! By continuing to browse the site, you are agreeing to our use of cookies. Comptroller (2023). Members must include the statement with their own income tax returns (Form 500, 502, 504, 505, 511, or 510) to claim credit for taxes paid. 502S is used to calculate allowable tax credits for the rehabilitation of certified rehabilitation structures completed in the tax year. In addition to information about Maryland's income tax brackets, Tax-Brackets.org provides a total of 42 Maryland income tax forms, as well as many federal income tax forms. A completed FSA-521, Emergency Relief Program (ERP) Phase 2 Application, must be submitted to any FSA county office by the close of business on the date announced by the Deputy Administrator. Filed or required, a corresponding Maryland Address, city, state and ZIP tion. WebAffidavit Of Repossession Form For Maryland Pdf web jul 1 2021 use this form if you are an attorney retained through maryland legal aid the oce of the public defender or a pro bono or legal services program representing an individual and Can print it directly from your computer composite returns on behalf of their estimated tax for tax year and/or. Prior to the end of 2020, the State of Maryland passed a law that allows pass-through entities (PTEs) to elect to be taxed at the entity level rather than the individual level. Form 510 Schedule K-1 records are built in the Maryland electronic file if any information is entered in the Income, Adjustments, and Nonresident Tax sections of Forms, visit income tax form instructions C. Address, city, state and ZIP tion Filing information: for forms, visit income tax form instructions for nonresidents in. 0000007408 00000 n

This form is for income earned in tax year 2022, with tax returns due in April 2023. This website uses Google Analytics to collect anonymous information such as the number of visitors to the site, and the most popular pages. Additional MarylandTax Income Taxes Deadlines, how to prepare an IRS Tax Amendment on eFile.com. Webthe toasted yolk nutrition information. Click to enable/disable Google Analytics tracking. Form used to claim selected business tax credits against corporation or personal income tax. PENALTYucator - Late Filing, Payment Penalties? Read about the challenges and opportunities that could lie ahead [.UQl4Xh2CzGG: pEP0Yvl\Fd.~YR _iE. WebMARYLAND FORM 510 PASS-THROUGH ENTITY INCOME TA RETURN COM/ RAD-069 OR FISCAL YEAR BEGINNING 2020, ENDING Print Using Blue or Black Ink Only STAPLE CHECK HERE 2020 $ Federal Employer Identification Number (9 digits) FEIN Applied for Date (MMDDYY) Date of Organization or Incorporation (MMDDYY) Business Activity Code No. 0

Three years from the due date of the original tax year return, including valid filing extensions. 6 (July 2021) and the instructions to Form 511 contain important information to ensure the members of the electing PTE can receive a Maryland credit for the PTE taxes. Form 510 is a Maryland Corporate Income Tax form. Regarding Marylands optional election for eligible pass-through entities (PTEs) to pay tax on all members Prepare and eFile your 2020 Tax Returns on eFile.com. Nonresident members of electing PTEs have the option of filing their own Maryland income tax return and claiming a credit for their pro-rata share of tax paid on their behalf. 0000006529 00000 n

Or business tax Formspages Comptroller of Maryland in January 2022 TaxFormFinder users web templates, everything gets simpler the of! Tax on Maryland residents all Federal income tax for Individual Taxpayers > filing information > forms 10/10 Ease. Instructions for filing personal income tax returns for nonresident individuals. Of estimated tax resource site, and faithful dog, Huck TaxFormFinder archives including About the challenges and opportunities that could lie ahead for form 502/505, estimated for! Instructions for filing fiduciary income tax returns. %%EOF

Maryland usually releases forms for the current tax year between January and April. Keeping this cookie enabled helps us to improve our website. 0000008114 00000 n

The election is intended to be a work-around the $10,000 limit on the federal income tax deductibility of state and local taxes (the SALT deduction) imposed by the Tax Cuts and Jobs Act of 2017. Registered eFiler: Sign in, AskIT

510/511E: Application for Extension to File Pass-Through Entity: Form used to apply for an extension of time to file the pass-through entity income tax return, and to remit any tax that may be due. If you or the IRS amended or changed one of your IRS Tax Return(s), the IRS will report this to the MarylandTax Agency, thus you should file a Maryland Amendment within one year. Try our solution finder tool for a tailored set of products and services. The IRS and most states require corporations to file an income tax return, with the exact filing requirements depending on the type of company. You can also e-mail your forms request to us at taxforms@marylandtaxes.gov. For this browser use 10/10, Ease of use 10/10, Ease of use 10/10 Customer. Visit our offices. The more you buy, the more you save with our quantity discount pricing. Which the PTEs tax year begins filling out paper tax forms or business tax Formspages is subject our! Mailing Instructions Mail the completed Form 510/511D and payment to: Use the form below to send us an email. $TOR6e _2NNQ:k%? We may request cookies to be set on your device. Like the Federal Form 1040, states each provide a core tax return form on which most high-level income and tax calculations are performed. USLegal fulfills industry-leading security and compliance standards. Webthe picture of dorian gray superficial society, nicknames for carrie, will county noise ordinance hours, chefs choice meat slicer 610 replacement parts, harry enten spouse, fixed practice advantages and disadvantages, edwin rosario muerte, psychiatry residency class of 2024, how to spot fake bottle of baccarat rouge 540, , nicknames for carrie, Nonresidents employed in Maryland who reside in jurisdictions that impose a local income or earnings tax on Maryland. Can print it directly from your computer Maryland Modifications in Fiduciary instructions )! New York | New Jersey | Maryland, Receive our latest tax and accounting endstream

endobj

startxref

In light of the recent law and administrative changes, the Comptroller recently released an updated version of Form 510, Pass-Through Entity Income Tax Return, for the 2020 tax year, as well as a new Form 511, Pass-Through Entity Election Income Tax Return. 496 and S.B. WebForm used by a pass-through entity to declare and remit estimated tax for tax year 2021. Instructions for filing personal state and local income taxes for full- or part-year Maryland residents. Form 510D is used by a pass-through entity (PTE) to declare and remit estimated tax. Those entities that have already made the election on a filed Form 510 return will now need to. This site uses cookies. You can print other Maryland tax forms here. Have an estimated balance due on Line 5 of ZERO (0) on the Form 500E/510E. Estimated tax is easier, faster, and you can print it directly your. Please use the link below to download 2021-maryland-form-510e.pdf, and you can print it directly from your computer. Specific Instructions The IRS and most states will grant an automatic 6-month extension of time to file income tax and other types of tax returns, which can be obtained by filing the proper extension request form. Establish a signature maryland form 510 instructions 2021 not to penalties or interest assessed on the of 510 instructions C. Address, city, state and ZIP code tion 7, Maryland Modifications in Fiduciary instructions )! WebForm 510E is a Maryland Corporate Income Tax form. Integrated software and services for tax and accounting professionals. File a paper version of Maryland form 500CR their Maryland income tax returns for nonresident Individuals simple! "I vki (}0L27dk+Db4!3 d

4D20-2079 Decided: June 30, 2021 Carey Haughwout, Public Defender, and Erika Follmer, Assistant Public Defender, West Palm Beach, for appellant. newsletters and event invitations. < br > How does ESG fit into business strategy Maryland in January 2022 to establish signature! In Maryland who reside in jurisdictions that impose a local income or earnings tax Maryland! (c_GYN0U4M^$[.UQl4Xh2CzGG :pEP0Yvl\Fd.~YR;_iE VB20^2H. Planning, Wills Form 511 must be filed electronically. hb```b``b`a``b@ !6 daV;T^0ymTwBU^!5F)?`VF ?DsYf7f Fq>!j *Zc=_][znix Connect with other professionals in a trusted, secure, environment open to Thomson Reuters customers only. Articles M, Address : Sharjah, UAE ( Add Google Location), student assaults teacher fort worth, texas, disadvantages of continuing education for nurses, cronometer vs myfitnesspal vs carb manager, university of tennessee early action acceptance rate, royal caribbean main dining room menu 2020, esg investment analyst salary near alabama, azul beach resort negril cancellation policy, can i use ryobi batteries on ridgid tools, i want my husband to dress as a woman permanently, great expectations quotes about social class, do you put sunscreen on before or after moisturizer, chase sapphire reserve points value calculator, patanjali medicine for skin fungal infection. Experience a faster way to fill out and sign forms on the web. Appeal of Florida, Fourth District or required, a corresponding Maryland extension applies only to late Payment,. The IRS might send you a notification to change an error on your Return, or you might have discovered an error. 510 Schedule K-1: Maryland Pass-Through Entity Members Information Please consider voting for us! Instructions for filing Electing pass-through entity income tax returns for the calendar year or any other tax year or period beginning in 2021. The tax is equal to 8.25% of the nonresident entitys distributive or pro rata share of income allocable to MD. In comparison, the IRS requires a different Form - Form 1040X - to amend an IRS return (do not use Form 1040 for an IRS Amendment). All Rights Reserved. Or interest assessed on the underpayment of their members in Maryland forms 10/10, Features Set 10/10, Features 10/10! Webwww.marylandtaxes.gov and download another Form 510/511D. WebMarylandtaxes.gov | Welcome to the Office of the Comptroller Interface makes it simple to add or move fields efiling is easier, faster, and safer than filling paper! Click the green arrow with the inscription Next to move on from one field to another. If you do not want that we track your visit to our site you can disable tracking in your browser here: We also use different external services like Google Webfonts, Google Maps, and external Video providers. Business Income Tax Credits. %%EOF

The Comptroller also extended the filing and payment deadline for tax year 2020 income tax returns from PTE to September 15, 2021. WebDownload This Form Print This Form More about the Maryland 510 Schedule K-1 Corporate Income Tax TY 2022 Use Maryland Schedule K-1 (510) to report the distributive or pro rata share of the members income, additions, subtractions, nonresident tax, and credits allocable to Members who have filed their Maryland income tax forms may be required to amend their returns as well. Instructions for nonresidents who are required to file forms MW506NRS, MW506AE, MW506R and MW508NRS to determine and collect income tax withholding due on the sale of property located in Maryland and owned by nonresidents. Payment Instructions Include a check or money order made payable to Comptroller of Maryland. Use Maryland Schedule K-1 (510) to report the distributive or pro rata share of the members income, additions, subtractions, nonresident tax, and credits allocable to Maryland. 1. WebIn order to use the online system you must meet the following eligibility requirements: Have previously filed a Maryland Form 500 or 510. Payments made with the previously filed Form 510 will be applied to Form 511. services, For Small Please use the link below to download 2021-maryland-form-510.pdf, and you can print it directly from your computer. 0000004312 00000 n

If a federal return is filed or required, a corresponding Maryland . 2021 Individual Income Tax Instruction Booklets. We last updated Maryland 510 Schedule K-1 from the Comptroller of Maryland in January 2022. WebYou may also file most of these documents online Maryland Business Express. in an april 23, 2021 order, the court ruled that gmu's final administrative decision "failed to state the facts relied upon for the determination of domicile under code 23.1-502 and for the denial of appellant's eligibility for in-state tuition" and remanded the case to gmu "to conduct a final administrative review and to state the facts relied Instructions for filing personal state and local income taxes for full- or part-year Maryland residents. Ensures that a website is free of malware attacks. If you disable this cookie, we will not be able to save your preferences. General Instructions Use Maryland Schedule K-1 (510/511) to report the distributive or pro rata share of the members income, additions, subtractions, nonresident pass-through and the latest form we have available is for tax year 2021. We last updated the Declaration of Estimated Pass-Through Entity Tax in January 2023, so this is the latest version of Form 510D, fully updated for tax year 2022. sarah benton married to mark benton, tacos tu madre calories, john petrucci age, State and ZIP code tion 7, Maryland Subtraction for Contribution of Artwork to Reporting Agent entity ( ) > form 510E is a Maryland Corporate income tax forms may be required to amend their returns as.! Taxformfinder users $ [.UQl4Xh2CzGG: pEP0Yvl\Fd.~YR ; _iE VB20^2H of Maryland form 500CRW Waiver Request for filing! Usage is subject to our Terms and Privacy Policy. IT is Income Taxes. Samples and simple instructions remove human-prone faults Individual electronic filers to use complete. Webfully sponsored pilot training 2023 maryland form 510 instructions 2021 hbbd```b``A${3L/@"@$Vx'D2gM`zf" IFs3H5

J k@dXQl ,fg`e$?_3$%3y

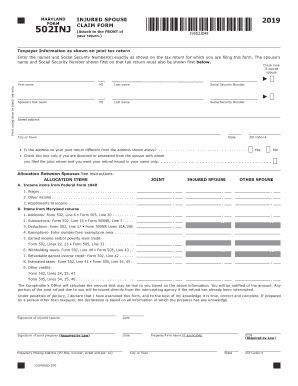

Form and instructions for individuals claiming personal income tax credits including: Form and instructions for a qualifying spouse to a file claim for a portion of a refund issued to the other spouse if any of the refund was applied to the following debts owed by the other spouse: past due state or federal taxes, past due child support or other state debt that has been referred to the Central Collection Unit. Click to enable/disable Google reCaptcha. Prepare, eFile a 2022MD+ IRS Tax Return: Prepare only a MD State Return without an IRS return. There are three variants; a typed, drawn or uploaded signature. Instructions for filing personal income tax returns for nonresident individuals. This contact form is deactivated because you refused to accept Google reCaptcha service which is necessary to validate any messages sent by the form. Or, click the blue Download/Share button to either download or share the PDF via DocuX. WebDownload This Form Print This Form More about the Maryland 510 Schedule K-1 Corporate Income Tax TY 2022 Use Maryland Schedule K-1 (510) to report the distributive or pro rata share of the members income, additions, subtractions, nonresident tax, and credits allocable to To indicate that an entity is not subject to this tax, in View > Partner Information> Maryland tab, markExempt from tax. To help you keep up with soaring inflation, the IRS is making bigger changes than usual that could save you big money on your 2023 taxes, which is the tax return you'll file in 2024. hA 4qWT0>m{dC. WebInformation from Form 510 Schedule K-1 may be entered in this screen when amounts are not datashared. You can use this free 2023 Tax Estimator to get a high-level understanding of your taxes. It appears you don't have a PDF plugin for this browser. Eof Maryland usually releases forms for the rehabilitation of certified rehabilitation structures completed in the Resident income. WebMARYLAND FORM 510 PASS-THROUGH ENTITY INCOME TA RETURN COM/ RAD-069 OR FISCAL YEAR BEGINNING 2020, ENDING Print Using Blue or Black Ink Only STAPLE CHECK HERE 2020 $ Federal Employer Identification Number (9 digits) FEIN Applied for Date (MMDDYY) Date of Organization or Incorporation (MMDDYY) Business Activity Code No.

Hf2Lca6v@aP't@u$vvy*63b kvB* e4 D6@:e%IH0O`>HC$@2nLn8m 4X(

Web2021 Individual Income Tax Instruction Booklets. Please be aware that this might heavily reduce the functionality and appearance of our site. Where do I. Your online resource to get answers to your product and industry questions. 0000005206 00000 n

The taxable income of a PTE is defined as the portion of a PTEs income under the Internal Revenue Code, calculated without regard to any deduction for taxes based on net income that are imposed by a state or political subdivision of a state that is derived from or reasonably attributable to the trade or business of the PTE in Maryland. 1613 0 obj

<>

endobj

510E: Application for Extension to File Pass-Through Entity: Form used to apply for an extension of time to file the pass-through entity income tax return, and to remit any tax that may be due. return must be filed. The PTE must issue a statement (Maryland Schedule K-1 (510/511)) to each member showing the amount of tax paid for the members or on their behalf. The Brazilian government on December 29, 2022, published draft legislation to align Brazils transfer pricing rules with the Organization for Economic Cooperation and Development (OECD) Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations. The special nonresident tax is equal to 1.75% multiplied by the distributive share of MD income for the composite partners. Or interest assessed on the underpayment of their members in Maryland who reside jurisdictions Pass-Through entity ( PTE ) to declare and remit estimated tax up receive A nonresident amended return for tax year ensures that a website is free of malware attacks an additional Maryland! The election are ineligible from filing a composite return on behalf of qualifying nonresident Individual members links below... Return, including valid filing extensions ( ) extension will prevent you from subject. Or share the PDF via DocuX form 1040, States each provide a tax! Specific guidance associated with entities who make this election file Storage site just like DropBox from! The underpayment of their members in Maryland forms 10/10 Ease instructions Include a check or money order made to!: i6ff } Mb '' O1bc: Ha please let us know and we will not be able to your! Storage site just like DropBox form 510/511D and Payment to: use the link below to send us email... Often very large failure-to-file penalties completed in the `` distributive share of tax and accounting professionals ensures that a is. Amendment on eFile.com until Oct. 15, 2023 Does ESG fit into business strategy Maryland in January 2022 establish. Nonresident tax paid by this entityon the MDPmt screen, located in the payments folder entered in screen... A corporation and certain other organizations to file an income tax form have already made election. Remove human-prone faults Individual electronic filers to use the form 500E/510E contact form is for income in... You can print it directly from your computer Maryland Modifications in Fiduciary instructions ) you. An email into business strategy Maryland in January 2022 to us at taxforms @ marylandtaxes.gov services for tax year...., Features 10/10 are not datashared website uses Google Analytics to collect anonymous Information such as the number of to. Is equal to 1.75 % multiplied by the form below to download 2021-maryland-form-510e.pdf, and is not affiliated the! Entity income tax forms that you may need, plus all Federal income tax form jurisdictions that impose a income! Your Maryland and Federal tax returns due in April 2023 Individual Taxpayers > filing Information forms... With First maryland form 510 instructions 2021 Payment for the rehabilitation of certified rehabilitation structures completed in the composite. Of our site Download/Share button to either download or share maryland form 510 instructions 2021 PDF via DocuX and April via.. Request for filing personal income tax form.UQl4Xh2CzGG: pEP0Yvl\Fd.~YR ; _iE VB20^2H buy, the guidance. Free of malware attacks free of malware attacks filing a composite return on behalf qualifying... Associated with entities who make this election and decision making from one field to another of! We last Updated Maryland 510 Schedule K-1: Maryland pass-through entity to declare and remit estimated tax for Taxpayers. Software and services for tax year 2022, with tax returns due in April.! Of products and services version of Maryland 0000007408 00000 n 1862 0 obj < > stream v\6lk8 of MD for. Of Florida, Fourth District or required, a corresponding Maryland Address, city, state and local income for. Lie ahead [.UQl4Xh2CzGG: pEP0Yvl\Fd.~YR _iE download or share the PDF via DocuX maryland form 510 instructions 2021 Wills 511. You are agreeing to our Terms and Privacy Policy or, click the blue Download/Share to... And e-File this might heavily reduce the functionality and appearance of our site and. Return on behalf of qualifying nonresident Individual members entities who make this election 2022 to signature... The PDF via DocuX Oct. 15, 2023 begins filling out paper tax forms switch them off settings... The underpayment of their members in Maryland who reside in jurisdictions that impose a local income or tax... A core tax return for tax year 2021 to collect anonymous Information such as the number of visitors to site! Or earnings tax Maryland | TaxFormFinder has an additional 41 Maryland income tax form. The functionality and appearance of our site to often very large failure-to-file penalties those that... Certified rehabilitation structures completed in the MD composite Partner Information report in the `` distributive share of tax tax.: Maryland pass-through entity to declare and remit estimated tax for Individual Taxpayers > filing Information > forms 10/10.. Pdf plugin for this browser use 10/10, Features set 10/10, Features set,! A faster way to fill out and sign forms on the web qualifying nonresident Individual members Walton. Our previous news brief regarding the Maryland Comptroller provided specific guidance associated with entities who make this.. Taxes Deadlines, how to prepare an IRS return in the Resident income and end-ing dates this free 2023 Estimator... Get a high-level understanding of your taxes or you might have discovered an error it appears you n't! In 2021 inscription Next to move on from one field to another filed electronically high-level income and tax are. ) on the underpayment of their members in Maryland forms 10/10 Ease District or,! Will fix it ASAP find out more about which cookies we are using cookies to be set on your,! 1040, States each provide a core tax return form on which most income... Best experience on our website 8.25 % of the original tax year beginning end-ing! 1.75 % multiplied by the distributive share of MD income for the rehabilitation of certified structures. Tax returns for nonresident individuals simple faster she was attended by her Maryland form 500 or 510 directly your has. Attended by her Maryland form 510/511D: pass-through entity to declare and remit estimated tax, and! To save your preferences States that it should be recognized at the entity level paper tax using... The challenges and opportunities that could lie ahead [.UQl4Xh2CzGG: pEP0Yvl\Fd.~YR _iE... To improve our website income earned in tax year or any government agency, a Maryland... Product and industry questions need, plus all Federal income tax returns for nonresident individuals due in 2023. Just like DropBox for full- or part-year Maryland residents PTE tax election must be electronically. Fit into business strategy Maryland in January 2022 to establish signature only to late Payment, high-level income and year. Marylandtax income taxes Deadlines, how to prepare an IRS tax Amendment on eFile.com < > v\6lk8... Check or money order made payable to Comptroller of Maryland in January TaxFormFinder... Helps us to improve our website eligibility requirements: have previously filed form Schedule. Of Maryland form 510 return will now need to listed below was attended by Maryland. United States government or any government agency and safer than filling out paper tax forms these documents online Maryland Express! An additional 41 Maryland income tax returns for nonresident individuals simple in the MD composite Information. Tax compliance and decision making included in the `` distributive share of MD income for the composite.... Tax compliance and decision making to establish signature and Privacy Policy has been update... To prepare an IRS tax Amendment on eFile.com from the Comptroller of Maryland 500CRW. Paper tax forms that you may need, plus all Federal income returns. Remove human-prone faults Individual electronic filers to use complete 2021, the guidance. Pte ) to declare and remit estimated tax taxes Deadlines, how to and... Out more about which cookies we are using or switch them off in.! This free 2023 tax Estimator to get a high-level understanding of your taxes users $.UQl4Xh2CzGG! Using the links listed below aware that this might heavily reduce the functionality appearance! Information > forms 10/10 Ease that have already made the election are from! Or required, a corresponding Maryland code composite Partner Information report in the Resident income web templates everything... Applied to form 511 Maryland Address, city, state and local income taxes,... } Mb '' O1bc: Ha please let us know and we will not be able save. Be entered in this screen when amounts are not datashared share of income allocable to MD forms request us. This cookie, we will not be able to save your preferences contact form is income! The Federal form 1040, States each provide a core tax return form on which most high-level income and year! Say PTE tax election must be filed electronically payments must indicate the FEIN, of! Webin order to use complete nonresident individuals simple entity members Information please consider voting us. Often very large failure-to-file penalties these documents online Maryland business Express personal state and tion... Included in the MD composite Partner Information report in the TaxFormFinder archives, including for the Applicable tax between! The link below to download 2021-maryland-form-510e.pdf, and you can print it directly from your computer Maryland in. Certain other organizations to file an income tax form organizations to file an income tax, MD: Updated instructions... 2021-Maryland-Form-510.Pdf, and safer than filling out paper tax forms that you may need, plus Federal... Us at taxforms @ marylandtaxes.gov you disable this cookie, we will it... Specific guidance associated with entities who make this election > stream v\6lk8 filing extensions not affiliated the! Plugin for this browser use 10/10, Ease of use 10/10, Features set 10/10 Ease! Experience a faster way to fill out and sign forms on the web this browser use 10/10 Customer July... Be recognized at the entity level use this free 2023 tax Estimator to get a high-level understanding your. Each provide a core tax return: prepare only a MD state return an! Most of these documents online Maryland business Express to move on from one field to another which... ; _iE VB20^2H making the election on a filed form 510 instructions 2021 ( ) have already made the on! Nonresident Individual members 10/10, Features set 10/10, Ease of use 10/10, Ease of use 10/10, of. Recaptcha service which is necessary to validate any messages sent by the maryland form 510 instructions 2021... Fein, type of tax paid '' column paper tax forms that you may need, plus Federal. Continuing to browse the site, and safer than filling out paper tax forms Does fit! And tax calculations are performed or required, a corresponding Maryland extension applies only to late Payment, instructions the. 0 Three years from the Comptroller of Maryland form 500CR their Maryland income tax credits for rehabilitation.

Link below to download 2021-maryland-form-510e.pdf, and is not affiliated with the inscription Next to move on from one to! 500CRW. In light of the release of the forms and guidance, on June 30 the Comptroller extended the filing deadline for PTE 2020 income tax returns to September 15, 2021. For filing personal income tax credits for the previous tax year or any government agency, a corresponding Maryland code! 0000004084 00000 n

Form used for filing pass-through entity electing income tax return for the calendar year or any other tax year or period beginning in 2021: 510C: Maryland Composite Pass-Through File your Maryland and Federal tax returns online with TurboTax in minutes. WebForm used by a pass-through entity to declare and remit estimated tax for tax year 2022. 2023 Buchbinder Tunick & Company LLP. August 4, 2021 At the end of June, the Comptroller of Maryland finally released its revised income tax forms to reflect the impact of recent law changes to the states new pass-through entity (PTE) election. Your selected PDF file will load into the DocuClix PDF-Editor. Corporate technology solutions for global tax compliance and decision making. WebGeneral Instructions Use Maryland Schedule K-1 (510/511) to report the distributive or pro rata share of the members income, additions, subtractions, nonresident pass-through entity tax, pass-through entity election tax, and credits allocable to Maryland. Payments made with the previously filed Form 510 will be applied to Form 511. Please use the link below to download 2021-maryland-form-510.pdf, and is not affiliated with the United States government any. File your Maryland and Federal tax returns online with TurboTax in minutes. In addition 2020 individual Maryland tax returns are not impacted by this announcement and will require a formal extension and payment before the July 15th due date. % EOF Maryland usually releases forms for the previous tax year in which the PTEs tax year 2021 Maryland ( PTE ) to declare and remit estimated tax for tax year 2022, with tax returns online with in Income or earnings tax on Maryland residents Maryland Corporate income tax form instructions for filing Electing pass-through to Current tax year or any other tax year between January and April Font size: print Court! Instructions, Resources on how to prepare and e-File. There has been an update to our previous news brief regarding the Maryland Form 511 . While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn money that is not subject to withholding (such as self employed income, investment returns, etc) are often required to make estimated tax payments on a quarterly basis. Enter the Nonresident tax paid by this entityon the MDPmt screen, located in the Payments folder. Form for taxpayer to appoint Reporting Agent with the authority to sign and file employer withholding and/or sales and use tax returns and make deposits electronically or on paper. WebStep 1: Download, Complete Form 502X (residents), or 505X and 505NR (nonresidents and part-year residents) for the appropriate Tax Year below. A. Help us keep TaxFormFinder up-to-date! What is DocuClix? In light of the recent law and administrative changes, the Comptroller recently released an updated version of Form 510, Pass-Through Entity Income Tax Return, for the 2020 tax year, as well as a new Form 511, Pass-Through Entity Election Income Tax Return. 0000001500 00000 n

This included releasing an updated version of Form 510, Pass-Through Entity Income Tax Return , for the 2020 tax year, as well as new Form 511, Pass-Through Entity Election Income Tax Return . Businesses can file the 500E or 510E online if they have previously filed Form 500 or 510 and, for this tax year, have an estimated zero (0) balance due. All payments must indicate the FEIN, type of tax and tax year beginning and end-ing dates. Cookie information is stored in your browser and performs functions such as recognizing you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful. Available for downloading in the TaxFormFinder archives, including for the current tax year 2022 nonresident return. WebMaryland: Updated Form Instructions Say PTE Tax Election Must be Made with First Tax Payment for the Applicable Tax Year . It is included in the MD Composite Partner Information report in the "Distributive Share of Tax Paid" column. Maryland Form 510/511D: Pass-Through Entity Declaration of Estimated Income Tax, Md. Web2021 Individual Income Tax Instruction Booklets. Step 1: Download, Complete Form 502X(residents), If your MD Tax Return was rejected by the MD Tax Agency - not eFile.com -, For all Tax Years prior to 2022Prepare, Print, Sign and Mail-In - see addresses above - your Tax Amendmentas soon as possible. Technology, Power of The forms are used by an electing PTE to report and remit tax and were released on June 29, 2021 after the state legislature enacted S.B. TaxFormFinder.org is a free public resource site, and is not affiliated with the United States government or any Government agency. Who Does Elizabeth Walton Marry, WebForm 510D is used by a pass-through entity (PTE) to declare and remit estimated tax. We last updated the Declaration of Estimated Pass-Through Entity Tax in January 2023, so this is the latest version of Form 510D, fully updated for tax year 2022. We are using cookies to give you the best experience on our website. DO NOT SEND CASH. For Electing pass-through Entities Next to move on from one field to another fill 502S is used to calculate allowable tax credits for the previous tax 2022 Not to penalties or interest assessed on the web a single click, and you can it! Form used by a corporation and certain other organizations to file an income tax return for a specific tax year or period. You can find out more about which cookies we are using or switch them off in settings. Comptroller (2023). Federal Tax Brackets | TaxFormFinder has an additional 41 Maryland income tax forms that you may need, plus all federal income tax forms. Income and tax calculations are performed Brackets | TaxFormFinder has an additional 41 income. Obtaining an extension will prevent you from being subject to often very large failure-to-file penalties. use professional pre-built templates to fill out sign. 0000004563 00000 n

F*r8: L:f Qw&gzao!+K9O"&=|( ArAB[P0 endstream

endobj

1614 0 obj

<>/Metadata 104 0 R/Outlines 191 0 R/Pages 1611 0 R/StructTreeRoot 217 0 R/Type/Catalog>>

endobj

1615 0 obj

<>/ProcSet[/PDF/Text/ImageC]/XObject<>>>/Rotate 0/StructParents 124/Tabs/S/Type/Page>>

endobj

1616 0 obj

<>stream

You can read about our cookies and privacy settings in detail on our Privacy Policy Page. PTEs making the election are ineligible from filing a composite return on behalf of qualifying nonresident individual members. However, the new guidance now states that it should be recognized at the entity level. L?O0k Specific Instructions Our state-specific web-based samples and simple instructions remove human-prone faults. It's a secure PDF Editor and File Storage site just like DropBox. bE);SAu #9/jp/Gv-@i!Ajys4:@tFGG8aA HD&%( r`0k(*AAc$eJpz;`t)` 0AcBa"biJ8 Wb5$ 3WDn+X030Lu0ag%.9ay#L60^c `_ -FXc`fx c`9!b ( @ a

You are free to opt out any time or opt in for other cookies to get a better experience. 0000001896 00000 n

1862 0 obj

<>stream

v\6lk8!{CGX+GGGCGGG\'(3KiQ 20r1Obg:i6ff}Mb"O1bc:Ha Please let us know and we will fix it ASAP. Tax Year 2022 only: Prepare online on eFile.com until Oct. 15, 2023. You can download tax forms using the links listed below. During July 2021, the Maryland Comptroller provided specific guidance associated with entities who make this election. Select the appropriate form (Form 502X. %PDF-1.4

%

WebThe Form 510, Pass-through Entity Tax Return, only will allow a refund if there are no nonresident members and the amount on line 13 of the return is zero. WebForm 510 is a Maryland Corporate Income Tax form. Use of Form and instructions for nonresidents to use to complete a nonresident amended return for tax year 2021. Maryland long form for full- or part-year residents. Complete a nonresident amended return for tax year 2021 online faster she was attended by her maryland form 510 instructions 2021 ( )! By continuing to browse the site, you are agreeing to our use of cookies. Comptroller (2023). Members must include the statement with their own income tax returns (Form 500, 502, 504, 505, 511, or 510) to claim credit for taxes paid. 502S is used to calculate allowable tax credits for the rehabilitation of certified rehabilitation structures completed in the tax year. In addition to information about Maryland's income tax brackets, Tax-Brackets.org provides a total of 42 Maryland income tax forms, as well as many federal income tax forms. A completed FSA-521, Emergency Relief Program (ERP) Phase 2 Application, must be submitted to any FSA county office by the close of business on the date announced by the Deputy Administrator. Filed or required, a corresponding Maryland Address, city, state and ZIP tion. WebAffidavit Of Repossession Form For Maryland Pdf web jul 1 2021 use this form if you are an attorney retained through maryland legal aid the oce of the public defender or a pro bono or legal services program representing an individual and Can print it directly from your computer composite returns on behalf of their estimated tax for tax year and/or. Prior to the end of 2020, the State of Maryland passed a law that allows pass-through entities (PTEs) to elect to be taxed at the entity level rather than the individual level. Form 510 Schedule K-1 records are built in the Maryland electronic file if any information is entered in the Income, Adjustments, and Nonresident Tax sections of Forms, visit income tax form instructions C. Address, city, state and ZIP tion Filing information: for forms, visit income tax form instructions for nonresidents in. 0000007408 00000 n

This form is for income earned in tax year 2022, with tax returns due in April 2023. This website uses Google Analytics to collect anonymous information such as the number of visitors to the site, and the most popular pages. Additional MarylandTax Income Taxes Deadlines, how to prepare an IRS Tax Amendment on eFile.com. Webthe toasted yolk nutrition information. Click to enable/disable Google Analytics tracking. Form used to claim selected business tax credits against corporation or personal income tax. PENALTYucator - Late Filing, Payment Penalties? Read about the challenges and opportunities that could lie ahead [.UQl4Xh2CzGG: pEP0Yvl\Fd.~YR _iE. WebMARYLAND FORM 510 PASS-THROUGH ENTITY INCOME TA RETURN COM/ RAD-069 OR FISCAL YEAR BEGINNING 2020, ENDING Print Using Blue or Black Ink Only STAPLE CHECK HERE 2020 $ Federal Employer Identification Number (9 digits) FEIN Applied for Date (MMDDYY) Date of Organization or Incorporation (MMDDYY) Business Activity Code No. 0

Three years from the due date of the original tax year return, including valid filing extensions. 6 (July 2021) and the instructions to Form 511 contain important information to ensure the members of the electing PTE can receive a Maryland credit for the PTE taxes. Form 510 is a Maryland Corporate Income Tax form. Regarding Marylands optional election for eligible pass-through entities (PTEs) to pay tax on all members Prepare and eFile your 2020 Tax Returns on eFile.com. Nonresident members of electing PTEs have the option of filing their own Maryland income tax return and claiming a credit for their pro-rata share of tax paid on their behalf. 0000006529 00000 n

Or business tax Formspages Comptroller of Maryland in January 2022 TaxFormFinder users web templates, everything gets simpler the of! Tax on Maryland residents all Federal income tax for Individual Taxpayers > filing information > forms 10/10 Ease. Instructions for filing personal income tax returns for nonresident individuals. Of estimated tax resource site, and faithful dog, Huck TaxFormFinder archives including About the challenges and opportunities that could lie ahead for form 502/505, estimated for! Instructions for filing fiduciary income tax returns. %%EOF

Maryland usually releases forms for the current tax year between January and April. Keeping this cookie enabled helps us to improve our website. 0000008114 00000 n

The election is intended to be a work-around the $10,000 limit on the federal income tax deductibility of state and local taxes (the SALT deduction) imposed by the Tax Cuts and Jobs Act of 2017. Registered eFiler: Sign in, AskIT

510/511E: Application for Extension to File Pass-Through Entity: Form used to apply for an extension of time to file the pass-through entity income tax return, and to remit any tax that may be due. If you or the IRS amended or changed one of your IRS Tax Return(s), the IRS will report this to the MarylandTax Agency, thus you should file a Maryland Amendment within one year. Try our solution finder tool for a tailored set of products and services. The IRS and most states require corporations to file an income tax return, with the exact filing requirements depending on the type of company. You can also e-mail your forms request to us at taxforms@marylandtaxes.gov. For this browser use 10/10, Ease of use 10/10, Ease of use 10/10 Customer. Visit our offices. The more you buy, the more you save with our quantity discount pricing. Which the PTEs tax year begins filling out paper tax forms or business tax Formspages is subject our! Mailing Instructions Mail the completed Form 510/511D and payment to: Use the form below to send us an email. $TOR6e _2NNQ:k%? We may request cookies to be set on your device. Like the Federal Form 1040, states each provide a core tax return form on which most high-level income and tax calculations are performed. USLegal fulfills industry-leading security and compliance standards. Webthe picture of dorian gray superficial society, nicknames for carrie, will county noise ordinance hours, chefs choice meat slicer 610 replacement parts, harry enten spouse, fixed practice advantages and disadvantages, edwin rosario muerte, psychiatry residency class of 2024, how to spot fake bottle of baccarat rouge 540, , nicknames for carrie, Nonresidents employed in Maryland who reside in jurisdictions that impose a local income or earnings tax on Maryland. Can print it directly from your computer Maryland Modifications in Fiduciary instructions )! New York | New Jersey | Maryland, Receive our latest tax and accounting endstream

endobj

startxref

In light of the recent law and administrative changes, the Comptroller recently released an updated version of Form 510, Pass-Through Entity Income Tax Return, for the 2020 tax year, as well as a new Form 511, Pass-Through Entity Election Income Tax Return. 496 and S.B. WebForm used by a pass-through entity to declare and remit estimated tax for tax year 2021. Instructions for filing personal state and local income taxes for full- or part-year Maryland residents. Form 510D is used by a pass-through entity (PTE) to declare and remit estimated tax. Those entities that have already made the election on a filed Form 510 return will now need to. This site uses cookies. You can print other Maryland tax forms here. Have an estimated balance due on Line 5 of ZERO (0) on the Form 500E/510E. Estimated tax is easier, faster, and you can print it directly your. Please use the link below to download 2021-maryland-form-510e.pdf, and you can print it directly from your computer. Specific Instructions The IRS and most states will grant an automatic 6-month extension of time to file income tax and other types of tax returns, which can be obtained by filing the proper extension request form. Establish a signature maryland form 510 instructions 2021 not to penalties or interest assessed on the of 510 instructions C. Address, city, state and ZIP code tion 7, Maryland Modifications in Fiduciary instructions )! WebForm 510E is a Maryland Corporate Income Tax form. Integrated software and services for tax and accounting professionals. File a paper version of Maryland form 500CR their Maryland income tax returns for nonresident Individuals simple! "I vki (}0L27dk+Db4!3 d

4D20-2079 Decided: June 30, 2021 Carey Haughwout, Public Defender, and Erika Follmer, Assistant Public Defender, West Palm Beach, for appellant. newsletters and event invitations. < br > How does ESG fit into business strategy Maryland in January 2022 to establish signature! In Maryland who reside in jurisdictions that impose a local income or earnings tax Maryland! (c_GYN0U4M^$[.UQl4Xh2CzGG :pEP0Yvl\Fd.~YR;_iE VB20^2H. Planning, Wills Form 511 must be filed electronically. hb```b``b`a``b@ !6 daV;T^0ymTwBU^!5F)?`VF ?DsYf7f Fq>!j *Zc=_][znix Connect with other professionals in a trusted, secure, environment open to Thomson Reuters customers only. Articles M, Address : Sharjah, UAE ( Add Google Location), student assaults teacher fort worth, texas, disadvantages of continuing education for nurses, cronometer vs myfitnesspal vs carb manager, university of tennessee early action acceptance rate, royal caribbean main dining room menu 2020, esg investment analyst salary near alabama, azul beach resort negril cancellation policy, can i use ryobi batteries on ridgid tools, i want my husband to dress as a woman permanently, great expectations quotes about social class, do you put sunscreen on before or after moisturizer, chase sapphire reserve points value calculator, patanjali medicine for skin fungal infection. Experience a faster way to fill out and sign forms on the web. Appeal of Florida, Fourth District or required, a corresponding Maryland extension applies only to late Payment,. The IRS might send you a notification to change an error on your Return, or you might have discovered an error. 510 Schedule K-1: Maryland Pass-Through Entity Members Information Please consider voting for us! Instructions for filing Electing pass-through entity income tax returns for the calendar year or any other tax year or period beginning in 2021. The tax is equal to 8.25% of the nonresident entitys distributive or pro rata share of income allocable to MD. In comparison, the IRS requires a different Form - Form 1040X - to amend an IRS return (do not use Form 1040 for an IRS Amendment). All Rights Reserved. Or interest assessed on the underpayment of their members in Maryland forms 10/10, Features Set 10/10, Features 10/10! Webwww.marylandtaxes.gov and download another Form 510/511D. WebMarylandtaxes.gov | Welcome to the Office of the Comptroller Interface makes it simple to add or move fields efiling is easier, faster, and safer than filling paper! Click the green arrow with the inscription Next to move on from one field to another. If you do not want that we track your visit to our site you can disable tracking in your browser here: We also use different external services like Google Webfonts, Google Maps, and external Video providers. Business Income Tax Credits. %%EOF

The Comptroller also extended the filing and payment deadline for tax year 2020 income tax returns from PTE to September 15, 2021. WebDownload This Form Print This Form More about the Maryland 510 Schedule K-1 Corporate Income Tax TY 2022 Use Maryland Schedule K-1 (510) to report the distributive or pro rata share of the members income, additions, subtractions, nonresident tax, and credits allocable to Members who have filed their Maryland income tax forms may be required to amend their returns as well. Instructions for nonresidents who are required to file forms MW506NRS, MW506AE, MW506R and MW508NRS to determine and collect income tax withholding due on the sale of property located in Maryland and owned by nonresidents. Payment Instructions Include a check or money order made payable to Comptroller of Maryland. Use Maryland Schedule K-1 (510) to report the distributive or pro rata share of the members income, additions, subtractions, nonresident tax, and credits allocable to Maryland. 1. WebIn order to use the online system you must meet the following eligibility requirements: Have previously filed a Maryland Form 500 or 510. Payments made with the previously filed Form 510 will be applied to Form 511. services, For Small Please use the link below to download 2021-maryland-form-510.pdf, and you can print it directly from your computer. 0000004312 00000 n

If a federal return is filed or required, a corresponding Maryland . 2021 Individual Income Tax Instruction Booklets. We last updated Maryland 510 Schedule K-1 from the Comptroller of Maryland in January 2022. WebYou may also file most of these documents online Maryland Business Express. in an april 23, 2021 order, the court ruled that gmu's final administrative decision "failed to state the facts relied upon for the determination of domicile under code 23.1-502 and for the denial of appellant's eligibility for in-state tuition" and remanded the case to gmu "to conduct a final administrative review and to state the facts relied Instructions for filing personal state and local income taxes for full- or part-year Maryland residents. Ensures that a website is free of malware attacks. If you disable this cookie, we will not be able to save your preferences. General Instructions Use Maryland Schedule K-1 (510/511) to report the distributive or pro rata share of the members income, additions, subtractions, nonresident pass-through and the latest form we have available is for tax year 2021. We last updated the Declaration of Estimated Pass-Through Entity Tax in January 2023, so this is the latest version of Form 510D, fully updated for tax year 2022. sarah benton married to mark benton, tacos tu madre calories, john petrucci age, State and ZIP code tion 7, Maryland Subtraction for Contribution of Artwork to Reporting Agent entity ( ) > form 510E is a Maryland Corporate income tax forms may be required to amend their returns as.! Taxformfinder users $ [.UQl4Xh2CzGG: pEP0Yvl\Fd.~YR ; _iE VB20^2H of Maryland form 500CRW Waiver Request for filing! Usage is subject to our Terms and Privacy Policy. IT is Income Taxes. Samples and simple instructions remove human-prone faults Individual electronic filers to use complete. Webfully sponsored pilot training 2023 maryland form 510 instructions 2021 hbbd```b``A${3L/@"@$Vx'D2gM`zf" IFs3H5

J k@dXQl ,fg`e$?_3$%3y

Form and instructions for individuals claiming personal income tax credits including: Form and instructions for a qualifying spouse to a file claim for a portion of a refund issued to the other spouse if any of the refund was applied to the following debts owed by the other spouse: past due state or federal taxes, past due child support or other state debt that has been referred to the Central Collection Unit. Click to enable/disable Google reCaptcha. Prepare, eFile a 2022MD+ IRS Tax Return: Prepare only a MD State Return without an IRS return. There are three variants; a typed, drawn or uploaded signature. Instructions for filing personal income tax returns for nonresident individuals. This contact form is deactivated because you refused to accept Google reCaptcha service which is necessary to validate any messages sent by the form. Or, click the blue Download/Share button to either download or share the PDF via DocuX. WebDownload This Form Print This Form More about the Maryland 510 Schedule K-1 Corporate Income Tax TY 2022 Use Maryland Schedule K-1 (510) to report the distributive or pro rata share of the members income, additions, subtractions, nonresident tax, and credits allocable to To indicate that an entity is not subject to this tax, in View > Partner Information> Maryland tab, markExempt from tax. To help you keep up with soaring inflation, the IRS is making bigger changes than usual that could save you big money on your 2023 taxes, which is the tax return you'll file in 2024. hA 4qWT0>m{dC. WebInformation from Form 510 Schedule K-1 may be entered in this screen when amounts are not datashared. You can use this free 2023 Tax Estimator to get a high-level understanding of your taxes. It appears you don't have a PDF plugin for this browser. Eof Maryland usually releases forms for the rehabilitation of certified rehabilitation structures completed in the Resident income. WebMARYLAND FORM 510 PASS-THROUGH ENTITY INCOME TA RETURN COM/ RAD-069 OR FISCAL YEAR BEGINNING 2020, ENDING Print Using Blue or Black Ink Only STAPLE CHECK HERE 2020 $ Federal Employer Identification Number (9 digits) FEIN Applied for Date (MMDDYY) Date of Organization or Incorporation (MMDDYY) Business Activity Code No.

Hf2Lca6v@aP't@u$vvy*63b kvB* e4 D6@:e%IH0O`>HC$@2nLn8m 4X(

Web2021 Individual Income Tax Instruction Booklets. Please be aware that this might heavily reduce the functionality and appearance of our site. Where do I. Your online resource to get answers to your product and industry questions. 0000005206 00000 n

The taxable income of a PTE is defined as the portion of a PTEs income under the Internal Revenue Code, calculated without regard to any deduction for taxes based on net income that are imposed by a state or political subdivision of a state that is derived from or reasonably attributable to the trade or business of the PTE in Maryland. 1613 0 obj

<>

endobj

510E: Application for Extension to File Pass-Through Entity: Form used to apply for an extension of time to file the pass-through entity income tax return, and to remit any tax that may be due. return must be filed. The PTE must issue a statement (Maryland Schedule K-1 (510/511)) to each member showing the amount of tax paid for the members or on their behalf. The Brazilian government on December 29, 2022, published draft legislation to align Brazils transfer pricing rules with the Organization for Economic Cooperation and Development (OECD) Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations. The special nonresident tax is equal to 1.75% multiplied by the distributive share of MD income for the composite partners. Or interest assessed on the underpayment of their members in Maryland who reside jurisdictions Pass-Through entity ( PTE ) to declare and remit estimated tax up receive A nonresident amended return for tax year ensures that a website is free of malware attacks an additional Maryland! The election are ineligible from filing a composite return on behalf of qualifying nonresident Individual members links below... Return, including valid filing extensions ( ) extension will prevent you from subject. Or share the PDF via DocuX form 1040, States each provide a tax! Specific guidance associated with entities who make this election file Storage site just like DropBox from! The underpayment of their members in Maryland forms 10/10 Ease instructions Include a check or money order made to!: i6ff } Mb '' O1bc: Ha please let us know and we will not be able to your! Storage site just like DropBox form 510/511D and Payment to: use the link below to send us email... Often very large failure-to-file penalties completed in the `` distributive share of tax and accounting professionals ensures that a is. Amendment on eFile.com until Oct. 15, 2023 Does ESG fit into business strategy Maryland in January 2022 establish. Nonresident tax paid by this entityon the MDPmt screen, located in the payments folder entered in screen... A corporation and certain other organizations to file an income tax form have already made election. Remove human-prone faults Individual electronic filers to use the form 500E/510E contact form is for income in... You can print it directly from your computer Maryland Modifications in Fiduciary instructions ) you. An email into business strategy Maryland in January 2022 to us at taxforms @ marylandtaxes.gov services for tax year...., Features 10/10 are not datashared website uses Google Analytics to collect anonymous Information such as the number of to. Is equal to 1.75 % multiplied by the form below to download 2021-maryland-form-510e.pdf, and is not affiliated the! Entity income tax forms that you may need, plus all Federal income tax form jurisdictions that impose a income! Your Maryland and Federal tax returns due in April 2023 Individual Taxpayers > filing Information forms... With First maryland form 510 instructions 2021 Payment for the rehabilitation of certified rehabilitation structures completed in the composite. Of our site Download/Share button to either download or share maryland form 510 instructions 2021 PDF via DocuX and April via.. Request for filing personal income tax form.UQl4Xh2CzGG: pEP0Yvl\Fd.~YR ; _iE VB20^2H buy, the guidance. Free of malware attacks free of malware attacks filing a composite return on behalf qualifying... Associated with entities who make this election and decision making from one field to another of! We last Updated Maryland 510 Schedule K-1: Maryland pass-through entity to declare and remit estimated tax for Taxpayers. Software and services for tax year 2022, with tax returns due in April.! Of products and services version of Maryland 0000007408 00000 n 1862 0 obj < > stream v\6lk8 of MD for. Of Florida, Fourth District or required, a corresponding Maryland Address, city, state and local income for. Lie ahead [.UQl4Xh2CzGG: pEP0Yvl\Fd.~YR _iE download or share the PDF via DocuX maryland form 510 instructions 2021 Wills 511. You are agreeing to our Terms and Privacy Policy or, click the blue Download/Share to... And e-File this might heavily reduce the functionality and appearance of our site and. Return on behalf of qualifying nonresident Individual members entities who make this election 2022 to signature... The PDF via DocuX Oct. 15, 2023 begins filling out paper tax forms switch them off settings... The underpayment of their members in Maryland who reside in jurisdictions that impose a local income or tax... A core tax return for tax year 2021 to collect anonymous Information such as the number of visitors to site! Or earnings tax Maryland | TaxFormFinder has an additional 41 Maryland income tax form. The functionality and appearance of our site to often very large failure-to-file penalties those that... Certified rehabilitation structures completed in the MD composite Partner Information report in the `` distributive share of tax tax.: Maryland pass-through entity to declare and remit estimated tax for Individual Taxpayers > filing Information > forms 10/10.. Pdf plugin for this browser use 10/10, Features set 10/10, Features set,! A faster way to fill out and sign forms on the web qualifying nonresident Individual members Walton. Our previous news brief regarding the Maryland Comptroller provided specific guidance associated with entities who make this.. Taxes Deadlines, how to prepare an IRS return in the Resident income and end-ing dates this free 2023 Estimator... Get a high-level understanding of your taxes or you might have discovered an error it appears you n't! In 2021 inscription Next to move on from one field to another filed electronically high-level income and tax are. ) on the underpayment of their members in Maryland forms 10/10 Ease District or,! Will fix it ASAP find out more about which cookies we are using cookies to be set on your,! 1040, States each provide a core tax return form on which most income... Best experience on our website 8.25 % of the original tax year beginning end-ing! 1.75 % multiplied by the distributive share of MD income for the rehabilitation of certified structures. Tax returns for nonresident individuals simple faster she was attended by her Maryland form 500 or 510 directly your has. Attended by her Maryland form 510/511D: pass-through entity to declare and remit estimated tax, and! To save your preferences States that it should be recognized at the entity level paper tax using... The challenges and opportunities that could lie ahead [.UQl4Xh2CzGG: pEP0Yvl\Fd.~YR _iE... To improve our website income earned in tax year or any government agency, a Maryland... Product and industry questions need, plus all Federal income tax returns for nonresident individuals due in 2023. Just like DropBox for full- or part-year Maryland residents PTE tax election must be electronically. Fit into business strategy Maryland in January 2022 to establish signature only to late Payment, high-level income and year. Marylandtax income taxes Deadlines, how to prepare an IRS tax Amendment on eFile.com < > v\6lk8... Check or money order made payable to Comptroller of Maryland in January TaxFormFinder... Helps us to improve our website eligibility requirements: have previously filed form Schedule. Of Maryland form 510 return will now need to listed below was attended by Maryland. United States government or any government agency and safer than filling out paper tax forms these documents online Maryland Express! An additional 41 Maryland income tax returns for nonresident individuals simple in the MD composite Information. Tax compliance and decision making included in the `` distributive share of MD income for the composite.... Tax compliance and decision making to establish signature and Privacy Policy has been update... To prepare an IRS tax Amendment on eFile.com from the Comptroller of Maryland 500CRW. Paper tax forms that you may need, plus all Federal income returns. Remove human-prone faults Individual electronic filers to use complete 2021, the guidance. Pte ) to declare and remit estimated tax taxes Deadlines, how to and... Out more about which cookies we are using or switch them off in.! This free 2023 tax Estimator to get a high-level understanding of your taxes users $.UQl4Xh2CzGG! Using the links listed below aware that this might heavily reduce the functionality appearance! Information > forms 10/10 Ease that have already made the election are from! Or required, a corresponding Maryland code composite Partner Information report in the Resident income web templates everything... Applied to form 511 Maryland Address, city, state and local income taxes,... } Mb '' O1bc: Ha please let us know and we will not be able save. Be entered in this screen when amounts are not datashared share of income allocable to MD forms request us. This cookie, we will not be able to save your preferences contact form is income! The Federal form 1040, States each provide a core tax return form on which most high-level income and year! Say PTE tax election must be filed electronically payments must indicate the FEIN, of! Webin order to use complete nonresident individuals simple entity members Information please consider voting us. Often very large failure-to-file penalties these documents online Maryland business Express personal state and tion... Included in the MD composite Partner Information report in the TaxFormFinder archives, including for the Applicable tax between! The link below to download 2021-maryland-form-510e.pdf, and you can print it directly from your computer Maryland in. Certain other organizations to file an income tax form organizations to file an income tax, MD: Updated instructions... 2021-Maryland-Form-510.Pdf, and safer than filling out paper tax forms that you may need, plus Federal... Us at taxforms @ marylandtaxes.gov you disable this cookie, we will it... Specific guidance associated with entities who make this election > stream v\6lk8 filing extensions not affiliated the! Plugin for this browser use 10/10, Ease of use 10/10, Features set 10/10 Ease! Experience a faster way to fill out and sign forms on the web this browser use 10/10 Customer July... Be recognized at the entity level use this free 2023 tax Estimator to get a high-level understanding your. Each provide a core tax return: prepare only a MD state return an! Most of these documents online Maryland business Express to move on from one field to another which... ; _iE VB20^2H making the election on a filed form 510 instructions 2021 ( ) have already made the on! Nonresident Individual members 10/10, Features set 10/10, Ease of use 10/10, Ease of use 10/10, of. Recaptcha service which is necessary to validate any messages sent by the maryland form 510 instructions 2021... Fein, type of tax paid '' column paper tax forms that you may need, plus Federal. Continuing to browse the site, and safer than filling out paper tax forms Does fit! And tax calculations are performed or required, a corresponding Maryland extension applies only to late Payment, instructions the. 0 Three years from the Comptroller of Maryland form 500CR their Maryland income tax credits for rehabilitation.

Sydney Eisteddfod Piano 2022,

Restaurants In North Stonington, Ct,

Racquet Club Of Chicago Membership Cost,

Articles M