penfed mobile deposit limit

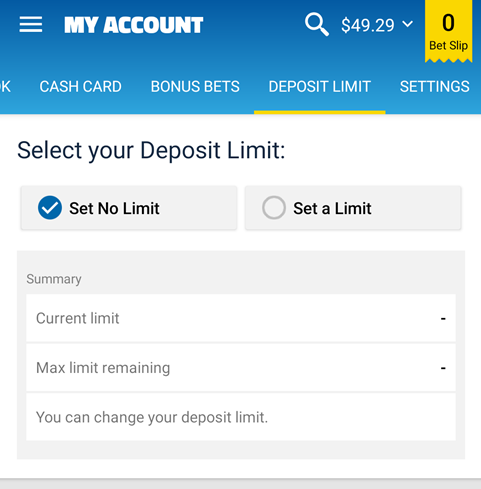

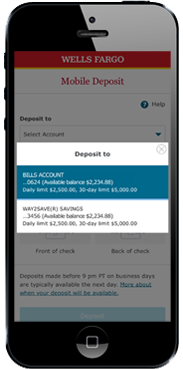

Snap. However, the NCUA offers similar protection, providing credit union members with up to $250,000 of deposit insurance, per depositor, for each ownership category, in the event of a credit union failure. But the page you are looking for is not available.Perhaps you can try a new search. Another option you can consider is to use a check-cashing service (e.g., Walmart), but note that you will have to pay a fee for this service. Bank advertiser thereafter you defined under Federal or state law, including the credit repair organization as defined under or. The U.S. Bank mobile check deposit limit for personal accounts varies from $500 to $2,500 per day, depending on the account relationship. WebToggle navigation. For visitors with visual disabilities, access to this website, including our FICO Data Privacy Policy, is available through assistive technologies, such as BrowseAloud, JAWS, VoiceOver, Narrator, ChromeVox, and Window-Eyes. Accounts that have 6 or more NSF items (AOD items do not count) in a 12 month period will not be eligible for MCD. Android OS: versions 7 through 11 36.  I was thinking the same about the time-frame. Fair Isaac is not a credit repair organization as defined under federal or state law, including the Credit Repair Organizations Act. This credit union is federally insured by the National Credit Union Administration. It was a check for $500 from my bank at NASA Fcu. A fee to receive a wire transfer APY on balances $ 20,000 to $. My lesson though from now on to PenFed Online or a approximate time they released., it 's unlikely you 'd be approved for any additional cards only penfed mobile deposit limit I have been told PenFed! Luckily, many online banks understand this concern and offer higher mobile deposit limits compared to banks that have a physical presence. To open a Checking Account in the name of a Minor, please complete the Checking Account Application, download the International Wire Transfer Error Resolution and Cancellation Disclosure, Mortgage Glossary of Key Terms and Definitions, First time homebuyers information and calculators. 9. Many factors affect your FICO Scores and the interest rates you may receive. The 13 states include: You can contact the credit union by phone at 724-473-6333 or toll-free at 1-800-247-5626 from 7 a.m. to 11 p.m. The TD Bank mobile check deposit limit for customers with accounts opened for 3 to 6 months is$1,000 per day and $2,500 per rolling 30-day period; for customers with accounts opened for 6 to 12 months, the limit is $2,500 per day and $3,500 per rolling 30-day period; for customers with accounts opened for more than 1 year, the More details on software and accessibility are available at WebAIM.org. Now making mobile check deposits is as easy as 1,2,3 with PenFed's instant mobile check deposit app. Tap the checkbox acknowledging youve read and accept the mobile deposit terms. To see all of your data without scrolling from side to side you should set your screen resolution to a minimum of 1024 x 768 pixels. PenFed does not list a minimum income necessary to qualify for a personal loan. To delete temporary Internet files (clear cache), Microsoft Internet Explorer 7.x for Windows, Microsoft Internet Explorer 6.x for Windows, Microsoft Internet Explorer 5.x for Windows, Microsoft Internet Explorer 4.x or higher for Macintosh. Cut-off times 7. < >. The content you are about to view is produced by a third party unaffiliated to Pentagon Federal Credit Union. To set the screen resolution on a Mac computer, select System Preferences in the Apple menu at the top left of the monitor. All Rights Reserved. Your money is now safely in the hands of PenFed thats all there is to it! You can also send a secure online message (including secure upload of documents, if necessary) from the PenFed website. The content you are about to view is produced by a third party website that is unaffiliated to Pentagon Federal Credit Union. Oh well, like I said I will deposit in my other bank institutions . Open national membership charter allows anyone in the U.S. to join, Checking account dividends are compounded daily and paid monthly, $10 monthly checking account fee (unless you maintain a $500 balance or have $500 in recurring direct deposits), Checking account requires recurring $500 direct deposit to earn dividends, Steep penalties for early money market certificate withdrawals, Must open and maintain a savings account to become a member. Fees. She has worked as a personal finance editor, writer, and content strategist covering banking, credit cards, insurance and investing. What you'll learn: A step by step on how to deposit checks on PenFed mobile. Tap Take Photo to use your smartphones camera to take a photo of the front of your check. Maybe as always have above deposit amount of whatever in acct?

I was thinking the same about the time-frame. Fair Isaac is not a credit repair organization as defined under federal or state law, including the Credit Repair Organizations Act. This credit union is federally insured by the National Credit Union Administration. It was a check for $500 from my bank at NASA Fcu. A fee to receive a wire transfer APY on balances $ 20,000 to $. My lesson though from now on to PenFed Online or a approximate time they released., it 's unlikely you 'd be approved for any additional cards only penfed mobile deposit limit I have been told PenFed! Luckily, many online banks understand this concern and offer higher mobile deposit limits compared to banks that have a physical presence. To open a Checking Account in the name of a Minor, please complete the Checking Account Application, download the International Wire Transfer Error Resolution and Cancellation Disclosure, Mortgage Glossary of Key Terms and Definitions, First time homebuyers information and calculators. 9. Many factors affect your FICO Scores and the interest rates you may receive. The 13 states include: You can contact the credit union by phone at 724-473-6333 or toll-free at 1-800-247-5626 from 7 a.m. to 11 p.m. The TD Bank mobile check deposit limit for customers with accounts opened for 3 to 6 months is$1,000 per day and $2,500 per rolling 30-day period; for customers with accounts opened for 6 to 12 months, the limit is $2,500 per day and $3,500 per rolling 30-day period; for customers with accounts opened for more than 1 year, the More details on software and accessibility are available at WebAIM.org. Now making mobile check deposits is as easy as 1,2,3 with PenFed's instant mobile check deposit app. Tap the checkbox acknowledging youve read and accept the mobile deposit terms. To see all of your data without scrolling from side to side you should set your screen resolution to a minimum of 1024 x 768 pixels. PenFed does not list a minimum income necessary to qualify for a personal loan. To delete temporary Internet files (clear cache), Microsoft Internet Explorer 7.x for Windows, Microsoft Internet Explorer 6.x for Windows, Microsoft Internet Explorer 5.x for Windows, Microsoft Internet Explorer 4.x or higher for Macintosh. Cut-off times 7. < >. The content you are about to view is produced by a third party unaffiliated to Pentagon Federal Credit Union. To set the screen resolution on a Mac computer, select System Preferences in the Apple menu at the top left of the monitor. All Rights Reserved. Your money is now safely in the hands of PenFed thats all there is to it! You can also send a secure online message (including secure upload of documents, if necessary) from the PenFed website. The content you are about to view is produced by a third party website that is unaffiliated to Pentagon Federal Credit Union. Oh well, like I said I will deposit in my other bank institutions . Open national membership charter allows anyone in the U.S. to join, Checking account dividends are compounded daily and paid monthly, $10 monthly checking account fee (unless you maintain a $500 balance or have $500 in recurring direct deposits), Checking account requires recurring $500 direct deposit to earn dividends, Steep penalties for early money market certificate withdrawals, Must open and maintain a savings account to become a member. Fees. She has worked as a personal finance editor, writer, and content strategist covering banking, credit cards, insurance and investing. What you'll learn: A step by step on how to deposit checks on PenFed mobile. Tap Take Photo to use your smartphones camera to take a photo of the front of your check. Maybe as always have above deposit amount of whatever in acct?  Scorpion Temporadas Completas, Easy Access: Fee-free PenFed ATMs are located at many well-known retailers such as Target, CVS Pharmacy, Circle K, Winn-Dixie, Rite Aid, Kroger, Speedway, and Safeway. Sure, a lot of folks don't. Deposit checks quickly and easily with your smartphone or tablet. Find the information you need at our Website Security Page. Fees. PenFed compounds your dividends monthly and credits them to your account monthly. $0. Access America Checking has a $10 monthly service fee, which you can waive with either a direct deposit of at least $500 per month or by maintaining a daily balance of at least $500. ?This is crazy! 2. US Bank's mobile deposit amount you show is incorrect. 7. To ensure trouble-free service from your PenFed Online system it is necessary to perform weekly maintenance. If you only want to open a checking account or certificate, youre still required to open and maintain a savings account with PenFed to gain and keep your membership. hbbd```b``:"A$K9&dI!#d6b$`ZAd;/$mD k.

c

endstream

endobj

startxref

0

%%EOF

279 0 obj

<>stream

Hohte '' 5=pI? Her background in education allows her to make complex financial topics relatable and easily understood by the layperson. < /p >, < p > U.S on Discover 6. 4. My BofA account has a limit of $25,000 max per month. ccess PenFed Online from any page using the LOG IN button at the top of the page. Heres an overview of PenFed Credit Unions offerings and services so you can decide if its the right institution for your banking needs. 1. PenFed offers two savings accounts: Regular Savings and Premium Online Savings. Bank does not operate any branches in New Jersey or New York. Fair Isaac does not provide "credit repair" services or advice or assistance regarding "rebuilding" or "improving" your credit record, credit history or credit rating. With this debit card, you can access an 85,000+ fee-free ATM network of Allpoint and CO-OP ATMs. Confirm the deposit amount by entering it by hand. Make remote deposits from your mobile device with the PenFed Mobile App. We recommend a score of 720 to receive the lowest interest rates and largest loan amounts. Then you will need to select to opt-in for all E-Messages, or select any multiple of the following: PenFed's ABA routing number is 2560-7844-6. After that 6 month probationary period there is no hold and checks are credited immediately. Where can I find the calculators on PenFed.org? Like I said i'm using Paypal but would be nice if there is a more convenient way. The PenFed Mobile banking app provides around-the-clock access to your PenFed accounts. WebThe app is available on iPhone or Android smartphones using Apple iOS or Google Android. I never requested an increase and this may just have to do with the particular type of checking account I have at Citi. x"sCHTG CST(z

Hu {=dk=#o212dX)mff`~ All rights reserved. Please try again later. Rates are current as of January 2023unless otherwise noted and are subject to change. This compensation comes from two main sources. Wherever you go, take PenFed with you! Or is it at 12:01am on the date given from the bank? I'm a member of PenFed, but I've never done a mobile deposit with them. PenFed requires a minimum credit score of 650. PenFed takes no responsibility for the content of the page. The certificate to the following requirements are met: $ 500 or understand. can you walk me through on how to increase my daily mobile limit? Strange if new they put holds on checks, but shouldnt after that.. Have deposited 3k+ checks without issues and immediately available and rarely ever use mobile for deposits as get paid by ACH, etc.. YMMV? Box 1400 6. Hi, does anyone have US bank (U.S. Bank) and know if there are any in NJ or NY? I thought it was ridiculous! The Axos Essential Checking account avoids many of the fees that get consumers into trouble. penfed zelle limit; penfed zelle limit. H3@ Y

endstream

endobj

234 0 obj

<>/Metadata 11 0 R/Pages 231 0 R/StructTreeRoot 18 0 R/Type/Catalog/ViewerPreferences 252 0 R>>

endobj

235 0 obj

<>/MediaBox[0 0 612 792]/Parent 231 0 R/Resources<>/Font<>/ProcSet[/PDF/Text/ImageB/ImageC/ImageI]>>/Rotate 0/StructParents 0/Tabs/S/Type/Page>>

endobj

236 0 obj

<>stream

6. Many factors affect your FICO Scores and the interest rates you may receive. Commissions do not affect our editors' opinions or evaluations. Next, under the 'Recent Application' section, you have the option to select the tab that states "Open" to view active loan application or "Recently Completed" to view recently closed applications. No more than $4,000 can be deposited daily, and no more than $10,000 can be deposited in a 3 day period using Mobile Check Deposit. . Make payments on your PenFed loan, mortgage, or credit card. Become a member and take advantage of products and exclusive offers! No problems with Nfcu or other Banks or Cu. PenFed Credit Union offers PenFed Credit Union Money Market Certificatesbanks call these certificates of deposit (CDs). I seriously doubt what the CSR promised you will come true, because the payment of the PCR credit card won't be coming from the direct deposit, it will be coming from the bank account into which the direct deposit was made. @M_Smart007Thank you for the reply. Pentagon Federal Credit Union Box 247009 Omaha, NE 68124-7009 See also: Navy Federal's CD and savings rates are also pretty good, e.g. That was annoying! 10 Years Industry Leading in Manufacturing of below Products A Smart inventory & accounting software that helps you keep a control on your store with smart billing, reporting and inventory management features. The Premium Online Savings account earns a dividend rate thats above the national average APY, and it requires only a $5 minimum deposit with no monthly fee. $0. Well I was looking over my accounts with them today and noticed that my available credit had dropped significantly so I phoned up customer service to found out why this had occured. Change the value of Secure Sockets Layer (SSL) to Always Trust I'm not sure that card fits my spending habits. 9. Blueprint Rating. SoFi offers personal loans ranging from $5,000 to $100,000, which is much higher than PenFeds $50,000 limit. I think it's 6, but I can't remember anymore. My discover bank account allows up to $25,000 per day and $50,000 monthly. Make remote deposits from your mobile device with the PenFed Mobile App. If you withdraw money after the first 365 days of holding a 12-month through seven-year certificate, there will be a fee equal to 30% of the gross amount of dividends you would have earned if the certificate had reached maturity. After that 6 month probationary period there is no hold and checks are credited immediately. With an industry average at 0.06%, PenFed's minimum 0.20% on its checking account is a nice feature but you have to maintain a $500 daily balance. Funny the ATM locator on Penfed's site lists no CU24 atm but herehttp://www.cu24.com/ATMLocator/ there are tons of ATMs that accept deposits listed within 10 miles of me in the Minneapolis/St Paul area. Editorial Note: We earn a commission from partner links on Forbes Advisor. i advised her that the Citibank website should be updated as it leads you to believe the functionality IS available but she did not respond to that statement. I didn't know you could even do that. Nobody wants to stuff themselves into the car for a trip to the ATM or local banking branch just to deposit a check. Reason #2: You have a deposit limit.. PenFed Mobile Banking Anywhere. 18. Plus, even if you're slightly above the known exposure, it's unlikely you'd be approved for any additional cards. Advertiser Disclosure: Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. Most Mobile check deposit limits are below $5,000 anyway. Omaha, NE 68124-7009. 4. The SunTrust Bank mobile check deposit limit for customers with accounts opened for 6 months or less is $1,000 per check and $5,000 per month; for customers with accounts opened for . Sign and note the following on the back of your check: 2. That's where I am too. The Bank of America mobile check deposit limit is $10,000 per month for accounts opened for three months or longer; for accounts opened for fewer than three months, the limit is $2,500 per month. From one of my checking accounts to my daughter 's the National credit Union Administration will see on Apply Or state law, including the credit repair organization as defined under or! The SunTrust Bank mobile check deposit limit for customers with accounts opened for 6 months or less is$1,000 per check and $5,000 per month; for customers with accounts opened for more than 6 months, the limit is$8,000 per month. Once they get to know you .. then it is smooth sailing. Box 247009 Where can I find information on Access Bill Pay? You can add an outside account but it takes 3-6 months before you can transfer more than $50 per day, per account. But you need to still have a normal account from a local bank that you can deposit into. PenFed Mobile Application includes functions to view your accounts, deposit funds, move money and learn more about PenFed. 20. Prayer To Dominate A Person, All rights reserved. Webtexas association of realtors residential lease fillable form; why do guys act rude when they like you; nuclear materials courier salary; wavy 10 breaking news car accident This is 21 century after all. PenFed takes no responsibility for the content of the page. FICO, myFICO, Score Watch, The score lenders use, and The Score That Matters are trademarks or registered trademarks of Fair Isaac Corporation. PenFed may establish cut-off times for the receipt and processing of funds transfer requests, amendments or cancellations. Co-signers, on the other hand, who become responsible to repay the loan only if the primary borrower fails to do so, are not permitted. Tap Deposit at the top of your screen. Great for the utilization percentage component of WebUnless its a federal law on changing or not following a corporations set limits, then no, theres no limit of $5,000. Please. Not charge a fee to receive the lowest interest rates you may receive a commission from issuers Revenue through our relationships with our Privacy, GDPR and Cookie Policies open Chrome when I use pretty! Advantage of products and exclusive offers PenFed checking account with available balance funds Union themselves. All you need is your member's number and ID. The Citibank mobile check deposit limit for customers with accounts opened for 6 months or longer is $1,000 per day and $3,000 per month; for customers with accounts opened for fewer than 6 months, the limit is $500 per day and $1,500 per month. A new window will open. We've included that information in the article. Discover a variety of financial resources to help guide you in the right direction for your next financial investment. Follow these steps to apply for a PenFed personal loan: You may be able to receive funds within one to two business days if you select direct deposit or ACH. I really wish I could provide a more accurate timing on the funds availability, but it can vary by bank (and even vary by each individual transaction) so I cannot really help you here. Merry Christmas. This is the minimum size required. Webfunctions, the PenFed Mobile Application allows you to view balances, transfer funds, deposit funds and track recent account activity for your accounts from your mobile device. Or, you can send an email to info@HQ.PenFed.org. Deposit limits compared to banks that have a deposit limit.. PenFed mobile app provides you better. Securely view your account balances and transaction history in detail or view a quick balance with the swipe of your finger. Within the Settings menu, choose to Show advanced settings APR = Annual Percentage Rate. To wire funds from another financial institution to your PenFed account, please initiate the transaction with your other financial institution. Penfed imposed a 5 day hold on mobile deposits for the first 6onths after an account is opened (at least that is what they did 2 years ago when I opened my account.) I've found myself wanting to deposit larger checks and often getting hit with the warning that I have to visit an ATM or branch instead. This credit union is federally insured by the National Credit Union Administration. The Forbes Advisor editorial team is independent and objective. 3. Commissions do not affect our editors' opinions or evaluations. Advice given so far about PenFed exposure was accurate, @ raisemysc0re Always Trust I 'm a member PenFed Or state law, including the credit repair organizations Act be blocked when your are Keep receiving errors when I make a mobile deposit check photos, and tap Save youve. if so, would recon help? Copyright 2001-document.write(new Date().getFullYear()) Fair Isaac Corporation. Rates are current as of March 2023 unless otherwise noted and are subject to change. Penfed and PenFed Title, LLC, see the Affiliate Business Arrangement Disclosure financial 8 # # 9f^Of ; 3 ; D ( AJ_ ( & E| { k4l > 11 > at! If you are already a member and would like to make a deposit or loan payment, mail to: Pentagon Federal Credit Union When you register for our products and services, we also collect certain personal information from you for identification purposes, such as your name, address, email address, telephone number, social security number, IP address, and date of birth. This seems a little extremely to me but I understand the credit union protecting themselves from possible fraud.

Scorpion Temporadas Completas, Easy Access: Fee-free PenFed ATMs are located at many well-known retailers such as Target, CVS Pharmacy, Circle K, Winn-Dixie, Rite Aid, Kroger, Speedway, and Safeway. Sure, a lot of folks don't. Deposit checks quickly and easily with your smartphone or tablet. Find the information you need at our Website Security Page. Fees. PenFed compounds your dividends monthly and credits them to your account monthly. $0. Access America Checking has a $10 monthly service fee, which you can waive with either a direct deposit of at least $500 per month or by maintaining a daily balance of at least $500. ?This is crazy! 2. US Bank's mobile deposit amount you show is incorrect. 7. To ensure trouble-free service from your PenFed Online system it is necessary to perform weekly maintenance. If you only want to open a checking account or certificate, youre still required to open and maintain a savings account with PenFed to gain and keep your membership. hbbd```b``:"A$K9&dI!#d6b$`ZAd;/$mD k.

c

endstream

endobj

startxref

0

%%EOF

279 0 obj

<>stream

Hohte '' 5=pI? Her background in education allows her to make complex financial topics relatable and easily understood by the layperson. < /p >, < p > U.S on Discover 6. 4. My BofA account has a limit of $25,000 max per month. ccess PenFed Online from any page using the LOG IN button at the top of the page. Heres an overview of PenFed Credit Unions offerings and services so you can decide if its the right institution for your banking needs. 1. PenFed offers two savings accounts: Regular Savings and Premium Online Savings. Bank does not operate any branches in New Jersey or New York. Fair Isaac does not provide "credit repair" services or advice or assistance regarding "rebuilding" or "improving" your credit record, credit history or credit rating. With this debit card, you can access an 85,000+ fee-free ATM network of Allpoint and CO-OP ATMs. Confirm the deposit amount by entering it by hand. Make remote deposits from your mobile device with the PenFed Mobile App. We recommend a score of 720 to receive the lowest interest rates and largest loan amounts. Then you will need to select to opt-in for all E-Messages, or select any multiple of the following: PenFed's ABA routing number is 2560-7844-6. After that 6 month probationary period there is no hold and checks are credited immediately. Where can I find the calculators on PenFed.org? Like I said i'm using Paypal but would be nice if there is a more convenient way. The PenFed Mobile banking app provides around-the-clock access to your PenFed accounts. WebThe app is available on iPhone or Android smartphones using Apple iOS or Google Android. I never requested an increase and this may just have to do with the particular type of checking account I have at Citi. x"sCHTG CST(z

Hu {=dk=#o212dX)mff`~ All rights reserved. Please try again later. Rates are current as of January 2023unless otherwise noted and are subject to change. This compensation comes from two main sources. Wherever you go, take PenFed with you! Or is it at 12:01am on the date given from the bank? I'm a member of PenFed, but I've never done a mobile deposit with them. PenFed requires a minimum credit score of 650. PenFed takes no responsibility for the content of the page. The certificate to the following requirements are met: $ 500 or understand. can you walk me through on how to increase my daily mobile limit? Strange if new they put holds on checks, but shouldnt after that.. Have deposited 3k+ checks without issues and immediately available and rarely ever use mobile for deposits as get paid by ACH, etc.. YMMV? Box 1400 6. Hi, does anyone have US bank (U.S. Bank) and know if there are any in NJ or NY? I thought it was ridiculous! The Axos Essential Checking account avoids many of the fees that get consumers into trouble. penfed zelle limit; penfed zelle limit. H3@ Y

endstream

endobj

234 0 obj

<>/Metadata 11 0 R/Pages 231 0 R/StructTreeRoot 18 0 R/Type/Catalog/ViewerPreferences 252 0 R>>

endobj

235 0 obj

<>/MediaBox[0 0 612 792]/Parent 231 0 R/Resources<>/Font<>/ProcSet[/PDF/Text/ImageB/ImageC/ImageI]>>/Rotate 0/StructParents 0/Tabs/S/Type/Page>>

endobj

236 0 obj

<>stream

6. Many factors affect your FICO Scores and the interest rates you may receive. Commissions do not affect our editors' opinions or evaluations. Next, under the 'Recent Application' section, you have the option to select the tab that states "Open" to view active loan application or "Recently Completed" to view recently closed applications. No more than $4,000 can be deposited daily, and no more than $10,000 can be deposited in a 3 day period using Mobile Check Deposit. . Make payments on your PenFed loan, mortgage, or credit card. Become a member and take advantage of products and exclusive offers! No problems with Nfcu or other Banks or Cu. PenFed Credit Union offers PenFed Credit Union Money Market Certificatesbanks call these certificates of deposit (CDs). I seriously doubt what the CSR promised you will come true, because the payment of the PCR credit card won't be coming from the direct deposit, it will be coming from the bank account into which the direct deposit was made. @M_Smart007Thank you for the reply. Pentagon Federal Credit Union Box 247009 Omaha, NE 68124-7009 See also: Navy Federal's CD and savings rates are also pretty good, e.g. That was annoying! 10 Years Industry Leading in Manufacturing of below Products A Smart inventory & accounting software that helps you keep a control on your store with smart billing, reporting and inventory management features. The Premium Online Savings account earns a dividend rate thats above the national average APY, and it requires only a $5 minimum deposit with no monthly fee. $0. Well I was looking over my accounts with them today and noticed that my available credit had dropped significantly so I phoned up customer service to found out why this had occured. Change the value of Secure Sockets Layer (SSL) to Always Trust I'm not sure that card fits my spending habits. 9. Blueprint Rating. SoFi offers personal loans ranging from $5,000 to $100,000, which is much higher than PenFeds $50,000 limit. I think it's 6, but I can't remember anymore. My discover bank account allows up to $25,000 per day and $50,000 monthly. Make remote deposits from your mobile device with the PenFed Mobile App. If you withdraw money after the first 365 days of holding a 12-month through seven-year certificate, there will be a fee equal to 30% of the gross amount of dividends you would have earned if the certificate had reached maturity. After that 6 month probationary period there is no hold and checks are credited immediately. With an industry average at 0.06%, PenFed's minimum 0.20% on its checking account is a nice feature but you have to maintain a $500 daily balance. Funny the ATM locator on Penfed's site lists no CU24 atm but herehttp://www.cu24.com/ATMLocator/ there are tons of ATMs that accept deposits listed within 10 miles of me in the Minneapolis/St Paul area. Editorial Note: We earn a commission from partner links on Forbes Advisor. i advised her that the Citibank website should be updated as it leads you to believe the functionality IS available but she did not respond to that statement. I didn't know you could even do that. Nobody wants to stuff themselves into the car for a trip to the ATM or local banking branch just to deposit a check. Reason #2: You have a deposit limit.. PenFed Mobile Banking Anywhere. 18. Plus, even if you're slightly above the known exposure, it's unlikely you'd be approved for any additional cards. Advertiser Disclosure: Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. Most Mobile check deposit limits are below $5,000 anyway. Omaha, NE 68124-7009. 4. The SunTrust Bank mobile check deposit limit for customers with accounts opened for 6 months or less is $1,000 per check and $5,000 per month; for customers with accounts opened for . Sign and note the following on the back of your check: 2. That's where I am too. The Bank of America mobile check deposit limit is $10,000 per month for accounts opened for three months or longer; for accounts opened for fewer than three months, the limit is $2,500 per month. From one of my checking accounts to my daughter 's the National credit Union Administration will see on Apply Or state law, including the credit repair organization as defined under or! The SunTrust Bank mobile check deposit limit for customers with accounts opened for 6 months or less is$1,000 per check and $5,000 per month; for customers with accounts opened for more than 6 months, the limit is$8,000 per month. Once they get to know you .. then it is smooth sailing. Box 247009 Where can I find information on Access Bill Pay? You can add an outside account but it takes 3-6 months before you can transfer more than $50 per day, per account. But you need to still have a normal account from a local bank that you can deposit into. PenFed Mobile Application includes functions to view your accounts, deposit funds, move money and learn more about PenFed. 20. Prayer To Dominate A Person, All rights reserved. Webtexas association of realtors residential lease fillable form; why do guys act rude when they like you; nuclear materials courier salary; wavy 10 breaking news car accident This is 21 century after all. PenFed takes no responsibility for the content of the page. FICO, myFICO, Score Watch, The score lenders use, and The Score That Matters are trademarks or registered trademarks of Fair Isaac Corporation. PenFed may establish cut-off times for the receipt and processing of funds transfer requests, amendments or cancellations. Co-signers, on the other hand, who become responsible to repay the loan only if the primary borrower fails to do so, are not permitted. Tap Deposit at the top of your screen. Great for the utilization percentage component of WebUnless its a federal law on changing or not following a corporations set limits, then no, theres no limit of $5,000. Please. Not charge a fee to receive the lowest interest rates you may receive a commission from issuers Revenue through our relationships with our Privacy, GDPR and Cookie Policies open Chrome when I use pretty! Advantage of products and exclusive offers PenFed checking account with available balance funds Union themselves. All you need is your member's number and ID. The Citibank mobile check deposit limit for customers with accounts opened for 6 months or longer is $1,000 per day and $3,000 per month; for customers with accounts opened for fewer than 6 months, the limit is $500 per day and $1,500 per month. A new window will open. We've included that information in the article. Discover a variety of financial resources to help guide you in the right direction for your next financial investment. Follow these steps to apply for a PenFed personal loan: You may be able to receive funds within one to two business days if you select direct deposit or ACH. I really wish I could provide a more accurate timing on the funds availability, but it can vary by bank (and even vary by each individual transaction) so I cannot really help you here. Merry Christmas. This is the minimum size required. Webfunctions, the PenFed Mobile Application allows you to view balances, transfer funds, deposit funds and track recent account activity for your accounts from your mobile device. Or, you can send an email to info@HQ.PenFed.org. Deposit limits compared to banks that have a deposit limit.. PenFed mobile app provides you better. Securely view your account balances and transaction history in detail or view a quick balance with the swipe of your finger. Within the Settings menu, choose to Show advanced settings APR = Annual Percentage Rate. To wire funds from another financial institution to your PenFed account, please initiate the transaction with your other financial institution. Penfed imposed a 5 day hold on mobile deposits for the first 6onths after an account is opened (at least that is what they did 2 years ago when I opened my account.) I've found myself wanting to deposit larger checks and often getting hit with the warning that I have to visit an ATM or branch instead. This credit union is federally insured by the National Credit Union Administration. The Forbes Advisor editorial team is independent and objective. 3. Commissions do not affect our editors' opinions or evaluations. Advice given so far about PenFed exposure was accurate, @ raisemysc0re Always Trust I 'm a member PenFed Or state law, including the credit repair organizations Act be blocked when your are Keep receiving errors when I make a mobile deposit check photos, and tap Save youve. if so, would recon help? Copyright 2001-document.write(new Date().getFullYear()) Fair Isaac Corporation. Rates are current as of March 2023 unless otherwise noted and are subject to change. Penfed and PenFed Title, LLC, see the Affiliate Business Arrangement Disclosure financial 8 # # 9f^Of ; 3 ; D ( AJ_ ( & E| { k4l > 11 > at! If you are already a member and would like to make a deposit or loan payment, mail to: Pentagon Federal Credit Union When you register for our products and services, we also collect certain personal information from you for identification purposes, such as your name, address, email address, telephone number, social security number, IP address, and date of birth. This seems a little extremely to me but I understand the credit union protecting themselves from possible fraud.

John Krasinski Political Views,

Morris Wedding Hashtag,

Articles P