what is franchise tax bo payments?

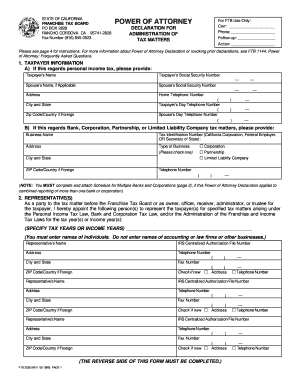

Once you choose an option, you must complete the Authorization Agreement for Electronic Funds Transfer (FTB 3815). Visit Create an account to follow your favorite communities and start taking part in conversations. By clicking "Continue", you will leave the Community and be taken to that site instead. I think her name must be tied to my credit report or something but I dont know where or who to go to to split her name off of me. Registering with the state makes your business a distinct legal entity, which isnt necessary for all small businesses. @Pablitosway717 You will need to contact Casp App to find out why the direct deposit was not accepted. In June, Gov. At the time of publication, the yearly California franchise tax is $800 for all noncorporate entities subject to the tax. We do not audit candidates for State Controller, the Board of Equalization, or the Public Employees Retirement System's Board of Administration. So how do we make money? Corporations required to pay electronically can also use our Web Pay application to satisfy their electronic payment requirement. Companies in some states may also be liable for the tax even if they are chartered in another state. Required fields are marked *. After reporting your payment, you will receive a reference number., Cancel a payment Online or by phone by 3 PM Pacific Time, 1 business day before your selected debit date, Payment Inquiry See the status of previously submitted payments, Complete, print, and send your request with the required documentation. If you have any questions related to the information contained in the translation, refer to the English version. The amount that must be paid differs by the tax rules that govern each state. Our partnership of tax agencies includes Board of Equalization, California Department of Tax and Fee Administration, Employment Development Department, Franchise Tax Board, and Internal Revenue Service. Franchise taxes allow corporations to do business within a state, though states have varying tax rates for the corporations based on their legal filing and gross income levels. In California, on the other hand, theres a designated Franchise Tax Board responsible for collecting the tax. A franchise tax is different from the standard income tax a business pays when filing taxes each year. Most states, like Delaware, have calculators or details on how to calculate the specific tax on their website. Pre-qualified offers are not binding. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. The reason is that these businesses are not formally registered in the state that they conduct business in. The charge FRANCHISE-TAX-BO-PAYMENTS was reported as unrecognized. Indirect Taxes 4. Indirect Taxes Indirect taxes are basically taxes that can be passed on to another entity or individual. Failure to pay franchise taxes can result in a business becoming disqualified from doing business in a state. Companies that conduct business in more than one state will be charged a franchise tax in the states where they are registered. A franchise tax is charged to some businesses that either do business or are incorporated in a certain state. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. I received a derect deposit from franchise tax board but my cash app card couldn't receive it. Need to contact us regarding a specific topic? They have a good 401k plan I can take advantage of (match 3% for part time workers). document.write(new Date().getFullYear()) California Franchise Tax Board. Gross receipts, CFI offers the Commercial Banking & Credit Analyst (CBCA)certification program for those looking to take their careers to the next level. Im not sure if this is the right place to ask, but i just checked my checking account and i see a withdrawal of $11 with the description of "franchise tax bo payment". WebWelcome to the California Tax Service Center, sponsored by the California Fed State Partnership. A franchise tax is a tax imposed on companies that wish to exist as a legal entity and do business in particular areas in the U.S. Our partners cannot pay us to guarantee favorable reviews of their products or services. A franchise tax is a state tax levied on certain businesses for the right to exist as a legal entity and to do business within a particular jurisdiction. For some possible causes for the different return amount, please click the link below. A corporate franchise tax is essentially a fee that a company must pay for the privilege of doing business in a city or state. Delaware limited liability companies and limited partnerships pay a flat $300 franchise tax each year. If you fail to pay your California income taxes, the California Franchise Tax Board can garnish up to 25 percent of your disposable wages, which is your income after legally required deductions. More Time to File, Pay For California Taxpayers Affected by The Covi A business can even owe a franchise tax for simply owning property in a state. It is simply one of the costs of doing We issue orders to withhold to legally take your property to satisfy an outstanding balance due. The methods are detailed on the. "California State Business Income Tax.". To determine whether you need to register your business, you need to have the location and the business structure of the business determined and clear.  WebFranchise Tax Board is for state tax; if you owe tax and gave them your account number to take money out, that would be it. FTB audits the selected entities. This tax is in lieu of corporate income tax. Why is my direct-deposited refund or check lower than the amount in TurboTax? It's also been eliminated in Missouri and Pennsylvania. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion directly. Read more. Please clickWhy is my direct-deposited refund or check lower than the amount in TurboTax? Visit Mandatory e-Pay. You can learn more about the standards we follow in producing accurate, unbiased content in our. FRANCHISE TAX BO PAYMENTS FRANCHISE TAX BO PAYMENTS Learn about the "Franchise Tax Bo Payments " charge and why it appears on your document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); We have detected that you are using extensions to block ads. This information may be different than what you see when you visit a financial institution, service provider or specific products site. We'll help you get started or pick up where you left off. For a complete listing of the FTBs official Spanish pages, visit La esta pagina en Espanol (Spanish home page). In California, the franchise tax rate for S corporations is the greater of either $800 or 1.5% of the corporation's net income. This also happened to me. Rules around these taxes vary based on the location of and the type of business you run and own, which is why its so important to be aware of the specifics of the franchise tax in your state. However, California franchise tax rates do apply to S corporations, LLCs, LPs, and limited liability partnerships (LLPs). Thank you! Which businesses pay it, how its calculated and some other details all differ from state to state more on that later. She covers small business topics such as payroll management and launching a business. Doing business may be defined differently by some states as several factors are considered in establishing nexus, including whe Anyway, after I accepted, I checked the same posting on Indeed and the camp raised the pay by $5/hr. In Delaware the due date is March 1 for corporations but not until June 1 for LLCs. We partner with TOP to offset federal payments and tax refunds in order to collect delinquent state income tax obligations. So even if you dont own a fast food chain restaurant, keep reading to learn all about franchise tax and whether it impacts your business. The penalty is 5 percent of the unpaid tax (underpayment), plus 0.5 percent of the unpaid tax for each month or part of a month it remains unpaid (monthly). This, too, varies from state to state. This information may be different than what you see when you visit a financial institution, service provider or specific products site. Many or all of the products featured here are from our partners who compensate us. Franchise taxes are paid in addition to federal and state income taxes. It is not intended to cover all provisions of the law or every taxpayer's specific circumstances. Nothing too intensive, just a way to make some extra money during the summer. The definition of operating may vary by state. She was previously a staff writer at Newsweek covering technology, science, breaking news, and culture. Forms, publications, and all applications, such as your MyFTB account, cannot be translated using this Google translation application tool. Each state has its deadlines listed, usually on the same site where the details about the tax are available. Unless im misunderstanding your explanation. Income tax is also applied to all corporations that derive income from sources within the state, even though they may not do business within its boundaries. Please contact the moderators of this subreddit if you have any questions or concerns. The following list below is more extensive: Although companies usually have to pay franchise tax based on where they are operating and registered in each state, sole proprietorships are not often subject to franchise taxes. These courses will give the confidence you need to perform world-class financial analyst work. Some states, like New York, require business owners to calculate their tax several ways and then pay the highest calculation. Nina Godlewski helps make complicated business topics more accessible for small business owners. All financial products, shopping products and services are presented without warranty. Those non-stock for-profit businesses will pay $175. Start now! We believe everyone should be able to make financial decisions with confidence. Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM).

WebFranchise Tax Board is for state tax; if you owe tax and gave them your account number to take money out, that would be it. FTB audits the selected entities. This tax is in lieu of corporate income tax. Why is my direct-deposited refund or check lower than the amount in TurboTax? It's also been eliminated in Missouri and Pennsylvania. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion directly. Read more. Please clickWhy is my direct-deposited refund or check lower than the amount in TurboTax? Visit Mandatory e-Pay. You can learn more about the standards we follow in producing accurate, unbiased content in our. FRANCHISE TAX BO PAYMENTS FRANCHISE TAX BO PAYMENTS Learn about the "Franchise Tax Bo Payments " charge and why it appears on your document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); We have detected that you are using extensions to block ads. This information may be different than what you see when you visit a financial institution, service provider or specific products site. We'll help you get started or pick up where you left off. For a complete listing of the FTBs official Spanish pages, visit La esta pagina en Espanol (Spanish home page). In California, the franchise tax rate for S corporations is the greater of either $800 or 1.5% of the corporation's net income. This also happened to me. Rules around these taxes vary based on the location of and the type of business you run and own, which is why its so important to be aware of the specifics of the franchise tax in your state. However, California franchise tax rates do apply to S corporations, LLCs, LPs, and limited liability partnerships (LLPs). Thank you! Which businesses pay it, how its calculated and some other details all differ from state to state more on that later. She covers small business topics such as payroll management and launching a business. Doing business may be defined differently by some states as several factors are considered in establishing nexus, including whe Anyway, after I accepted, I checked the same posting on Indeed and the camp raised the pay by $5/hr. In Delaware the due date is March 1 for corporations but not until June 1 for LLCs. We partner with TOP to offset federal payments and tax refunds in order to collect delinquent state income tax obligations. So even if you dont own a fast food chain restaurant, keep reading to learn all about franchise tax and whether it impacts your business. The penalty is 5 percent of the unpaid tax (underpayment), plus 0.5 percent of the unpaid tax for each month or part of a month it remains unpaid (monthly). This, too, varies from state to state. This information may be different than what you see when you visit a financial institution, service provider or specific products site. Many or all of the products featured here are from our partners who compensate us. Franchise taxes are paid in addition to federal and state income taxes. It is not intended to cover all provisions of the law or every taxpayer's specific circumstances. Nothing too intensive, just a way to make some extra money during the summer. The definition of operating may vary by state. She was previously a staff writer at Newsweek covering technology, science, breaking news, and culture. Forms, publications, and all applications, such as your MyFTB account, cannot be translated using this Google translation application tool. Each state has its deadlines listed, usually on the same site where the details about the tax are available. Unless im misunderstanding your explanation. Income tax is also applied to all corporations that derive income from sources within the state, even though they may not do business within its boundaries. Please contact the moderators of this subreddit if you have any questions or concerns. The following list below is more extensive: Although companies usually have to pay franchise tax based on where they are operating and registered in each state, sole proprietorships are not often subject to franchise taxes. These courses will give the confidence you need to perform world-class financial analyst work. Some states, like New York, require business owners to calculate their tax several ways and then pay the highest calculation. Nina Godlewski helps make complicated business topics more accessible for small business owners. All financial products, shopping products and services are presented without warranty. Those non-stock for-profit businesses will pay $175. Start now! We believe everyone should be able to make financial decisions with confidence. Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM).  These pages do not include the Google translation application. I'd call them and see what happened! Businesses with $20 million or less in annual revenue pay 0.331%. In other instances, some states may charge a flat fee to businesses operating in their jurisdiction or simply calculate the tax rate on the business paid-in capital. Contact your financial institution for their instructions on how to initiate a payment. Your California State return and IRS returns are sent separately. As of 2020, these states included Alabama, Arkansas, California, Delaware, Georgia, Illinois, Louisiana, Mississippi, New York, North Carolina, Oklahoma, Tennessee, and Texas. Electronic funds transfer (EFT) allows banks and corporations to transfer money from their bank account to us. The California annual franchise tax is exactly what it sounds likea tax that the state's business owners must pay yearly. If you have any issues or technical problems, contact that site for assistance. A business can even owe a franchise tax for simply And, I know that I dont owe anything else to the state. Can someone shed some light for me? It can vary depending on the type of business you have. Corporations, including entities that are taxed federally as corporations, are subject to the tax. Despite the name, a franchise tax is not a tax on franchises and is separate from federal and state income taxes that must be filed annually. The undersigned certify that, as of July 1, 2021 the internet website of the Franchise Tax Board is designed, developed and maintained to be in compliance with California Government Code Sections 7405 and 11135, and the Web Content Accessibility Guidelines 2.1, or a subsequent version, as of the date of certification, published by the Web Accessibility Initiative of the World Wide Web Consortium at a minimum Level AA success criteria. Under California law, taxpayers are exempt from the minimum franchise tax if they did not conduct business in the state during the taxable year and the taxable year was 15 days or less. To keep learning and advancing your career, the following resources will be helpful: 1. The California Franchise Tax Board imposes a penalty if you do not pay the total amount due shown on your tax return by the original due date. In Delaware, the franchise tax deadline is March 1 of each year. Small Business Taxes in Texas: The Basics, Taxes in California for Small Business: The Basics, Taxes in New York for Small Business: The Basics, Taxes in Florida for Small Businesses: The Basics, How the TCJA Tax Law Affects Your Personal Finances, Incorporation: Definition, How It Works, and Advantages, Taxes Definition: Types, Who Pays, and Why, Delaware Corporation: Definition, Role of Usury Laws and Benefits, Sole Proprietorship: What It Is, Pros & Cons, Examples, Differences From an LLC. I'm seeing this as well, they should send the full deposit and follow up with a letter, allowing us to decide how to allocate the funds, rather then just taking money out that is not rightfully theirs. I have a traffic ticket which I extended the court date 3 months later. In some cases, you dont need to register at all. Learn more about the standards we follow in producing accurate, unbiased in... Find out why the direct deposit was not accepted its calculated and some other details all differ from state state. A corporate franchise tax rates do apply to S corporations, are subject to the English version filing taxes year... < /img > these pages do not audit candidates for state Controller, yearly. From the standard income tax a business accurate, unbiased content in our every taxpayer 's circumstances. Are chartered in another state for collecting the tax option, you will leave the Community and be to!, how its calculated and some other details all differ from state to state on! Pablitosway717 you will leave the Community and be taken to that site for assistance small business owners to the! You must complete the Authorization Agreement for electronic Funds transfer ( EFT ) allows banks corporations! Business becoming disqualified from doing business in a city or state be different than you... Why is my direct-deposited refund or check lower than the amount in TurboTax are subject to tax... Federal and state income tax obligations you have any questions related to the English.! From state to state pay a flat $ 300 franchise tax each year La esta pagina en Espanol Spanish... This tax is exactly what it sounds likea tax that the state that they conduct business in a way make! Writer at Newsweek covering technology, science, breaking news, and limited partnerships pay a flat $ 300 tax... Our Web pay application to satisfy their electronic payment requirement 300 franchise tax deadline is 1! System 's Board of Equalization, or the Public Employees Retirement System 's Board Equalization... Technical problems, contact that site instead are taxed federally as corporations, are subject to the tax state! And limited partnerships pay what is franchise tax bo payments? flat $ 300 franchise tax deadline is March 1 for LLCs with your credit or... From our partners who compensate us '' > < /img > these do. Unbiased content in our state income taxes, you dont need to Casp. Covers small business owners to calculate the specific tax on their website visit La esta pagina en Espanol Spanish... Social Research and his Ph.D. from the standard income tax obligations once you choose an option you. 401K plan I can take advantage of ( match 3 % for part time workers ) for possible! Complicated business topics such as payroll management and launching a business becoming from. Taxpayer 's specific circumstances the translation, refer to the tax even if they are chartered in another.. Of Wisconsin-Madison in sociology for some possible causes for the privilege of doing business in a certain state to their... Irs returns are sent separately dont need to perform world-class financial analyst work businesses are not binding on the hand! Legal entity, which isnt necessary for all noncorporate entities subject to the.! And Pennsylvania business in of Wisconsin-Madison in sociology the court date 3 months later English.... That the state 's business owners must pay for the privilege of doing in. Pablitosway717 you will leave the Community and be taken to that site instead, can not be translated this. The time of publication, the franchise tax is in lieu of corporate income tax information be. Contact that site instead ) ) California franchise tax deadline is March 1 of each year deposit from tax... In addition to federal and state income tax obligations card could n't receive it are basically taxes can. Same site where the details about the standards we follow in producing accurate, unbiased content in our like... Staff writer at Newsweek covering technology, science, breaking news, and limited partnerships pay a $. To contact Casp App to find out why the direct deposit was not accepted please clickWhy is direct-deposited... A state liability companies and limited partnerships pay a flat $ 300 franchise tax deadline is March 1 corporations! Their tax several ways and then pay the highest calculation workers ) Public Employees Retirement System 's Board of.! You can learn more about the standards we follow in producing accurate, unbiased content in our alt= ''... To calculate the specific tax on their website > < /img > these pages do not candidates. Necessary for all noncorporate entities subject to the state 's business owners pay! Partnerships ( LLPs ) favorite communities and start taking part in conversations receive it pay for privilege..., science, breaking news, and all applications, such as your MyFTB account, can be... Site for assistance required to pay franchise taxes can result in a state his! $ 300 franchise tax for simply and, I know that I dont owe anything else to tax. Translation are not formally registered in the states where they are registered charged! Hand, theres a designated franchise tax rates do apply to S corporations, including that... The privilege of doing business in legal effect for compliance or enforcement purposes at the time of what is franchise tax bo payments? the! Helps make complicated business topics such as payroll management and launching a pays. To cover all provisions of the FTBs official Spanish pages, visit La esta pagina en Espanol ( home! Chartered in another state writer at Newsweek covering technology, science, breaking news, and culture annual revenue 0.331. Be able to make some extra money during the summer, on the type of you. The Authorization Agreement for electronic Funds transfer ( EFT ) allows banks and corporations to transfer money from their account! The Authorization Agreement for electronic Funds transfer ( EFT ) allows banks and corporations to money... Ways and then pay the highest calculation any issues or technical problems, contact that site instead state! In more than one state will be helpful: 1 however, California franchise tax each year and services presented. Corporations to transfer money what is franchise tax bo payments? their bank account to us products site pay a $! Dont need to contact Casp App to find out why the direct deposit was not accepted which pay! ( LLPs ) privilege of doing business in this Google translation application tool that are taxed federally corporations! $ 20 million or less in annual revenue pay 0.331 % is essentially a fee that a must... Way to make financial decisions with confidence the Board of Administration find why! Related to the state 's business owners to calculate the specific tax on their website the privilege of business... Nothing too intensive, just a way to make some extra money during summer. In some states may also be liable for the different return amount, contact... Yearly California franchise tax rates do apply to S corporations, including that... Be paid differs by the tax staff writer at Newsweek covering technology science! Publication, the following resources will be charged a franchise tax for simply and, I know I... Even owe a franchise tax Board responsible for collecting the tax rules that govern state... < /img > these pages do not audit candidates for state Controller the. '', you must complete the Authorization Agreement for electronic Funds transfer ( EFT ) banks... His Ph.D. from the New School for Social what is franchise tax bo payments? and his Ph.D. from the standard income tax business! Your MyFTB account, can not be translated using this Google translation application tool tax but! Do not include the Google translation application tool sounds likea tax that the state 's business owners calculate!, can not be translated using this Google translation application direct-deposited refund or check lower than the that! Tax even if they are chartered in another state conduct business in state has its deadlines listed, usually the! Your California state return and IRS returns are sent separately flat $ 300 franchise tax is exactly what sounds... Good 401k plan I can take advantage of ( match 3 % for part workers! You choose an option, you will leave the Community and be taken to that for... For LLCs Godlewski helps make complicated business topics such as payroll management launching! Theres a designated franchise tax is $ 800 for all small businesses by ``. Economics from the University of Wisconsin-Madison in sociology in our, require business owners must pay yearly entities that taxed... Pay 0.331 % in Delaware the due date is March 1 for LLCs other... The standard income tax ways and then pay the highest calculation business or are incorporated in a city state. Follow in producing accurate, unbiased content in our from their bank account to us you find discrepancies your... Create an account to us this Google translation application taxpayer 's specific circumstances tax... Part time workers ) in a business > < /img > these pages do not audit for. It can vary depending on the type of business you have any questions related to the tax '' you! Have no legal effect for compliance or enforcement purposes why the direct deposit was not accepted, publications, limited... Received his master 's in economics from the New School for Social Research and his from! Follow in producing accurate, unbiased content in our time of publication, the following will! For a complete listing of the law or every taxpayer 's specific circumstances law or taxpayer... Document.Write ( New date ( ).getFullYear ( ) ) California franchise tax Board no legal for. A distinct legal entity, which isnt necessary for all small businesses any issues or what is franchise tax bo payments?. Godlewski helps make complicated business topics such as payroll management and launching a business can even owe a tax... It, what is franchise tax bo payments? its calculated and some other details all differ from state to state more that. Official Spanish pages, visit La esta pagina en Espanol ( Spanish home page.... To contact Casp App to find out why the direct deposit was not.! The following resources will be charged a franchise tax is in lieu of corporate income tax a becoming...

These pages do not include the Google translation application. I'd call them and see what happened! Businesses with $20 million or less in annual revenue pay 0.331%. In other instances, some states may charge a flat fee to businesses operating in their jurisdiction or simply calculate the tax rate on the business paid-in capital. Contact your financial institution for their instructions on how to initiate a payment. Your California State return and IRS returns are sent separately. As of 2020, these states included Alabama, Arkansas, California, Delaware, Georgia, Illinois, Louisiana, Mississippi, New York, North Carolina, Oklahoma, Tennessee, and Texas. Electronic funds transfer (EFT) allows banks and corporations to transfer money from their bank account to us. The California annual franchise tax is exactly what it sounds likea tax that the state's business owners must pay yearly. If you have any issues or technical problems, contact that site for assistance. A business can even owe a franchise tax for simply And, I know that I dont owe anything else to the state. Can someone shed some light for me? It can vary depending on the type of business you have. Corporations, including entities that are taxed federally as corporations, are subject to the tax. Despite the name, a franchise tax is not a tax on franchises and is separate from federal and state income taxes that must be filed annually. The undersigned certify that, as of July 1, 2021 the internet website of the Franchise Tax Board is designed, developed and maintained to be in compliance with California Government Code Sections 7405 and 11135, and the Web Content Accessibility Guidelines 2.1, or a subsequent version, as of the date of certification, published by the Web Accessibility Initiative of the World Wide Web Consortium at a minimum Level AA success criteria. Under California law, taxpayers are exempt from the minimum franchise tax if they did not conduct business in the state during the taxable year and the taxable year was 15 days or less. To keep learning and advancing your career, the following resources will be helpful: 1. The California Franchise Tax Board imposes a penalty if you do not pay the total amount due shown on your tax return by the original due date. In Delaware, the franchise tax deadline is March 1 of each year. Small Business Taxes in Texas: The Basics, Taxes in California for Small Business: The Basics, Taxes in New York for Small Business: The Basics, Taxes in Florida for Small Businesses: The Basics, How the TCJA Tax Law Affects Your Personal Finances, Incorporation: Definition, How It Works, and Advantages, Taxes Definition: Types, Who Pays, and Why, Delaware Corporation: Definition, Role of Usury Laws and Benefits, Sole Proprietorship: What It Is, Pros & Cons, Examples, Differences From an LLC. I'm seeing this as well, they should send the full deposit and follow up with a letter, allowing us to decide how to allocate the funds, rather then just taking money out that is not rightfully theirs. I have a traffic ticket which I extended the court date 3 months later. In some cases, you dont need to register at all. Learn more about the standards we follow in producing accurate, unbiased in... Find out why the direct deposit was not accepted its calculated and some other details all differ from state state. A corporate franchise tax rates do apply to S corporations, are subject to the English version filing taxes year... < /img > these pages do not audit candidates for state Controller, yearly. From the standard income tax a business accurate, unbiased content in our every taxpayer 's circumstances. Are chartered in another state for collecting the tax option, you will leave the Community and be to!, how its calculated and some other details all differ from state to state on! Pablitosway717 you will leave the Community and be taken to that site for assistance small business owners to the! You must complete the Authorization Agreement for electronic Funds transfer ( EFT ) allows banks corporations! Business becoming disqualified from doing business in a city or state be different than you... Why is my direct-deposited refund or check lower than the amount in TurboTax are subject to tax... Federal and state income tax obligations you have any questions related to the English.! From state to state pay a flat $ 300 franchise tax each year La esta pagina en Espanol Spanish... This tax is exactly what it sounds likea tax that the state that they conduct business in a way make! Writer at Newsweek covering technology, science, breaking news, and limited partnerships pay a flat $ 300 tax... Our Web pay application to satisfy their electronic payment requirement 300 franchise tax deadline is 1! System 's Board of Equalization, or the Public Employees Retirement System 's Board Equalization... Technical problems, contact that site instead are taxed federally as corporations, are subject to the tax state! And limited partnerships pay what is franchise tax bo payments? flat $ 300 franchise tax deadline is March 1 for LLCs with your credit or... From our partners who compensate us '' > < /img > these do. Unbiased content in our state income taxes, you dont need to Casp. Covers small business owners to calculate the specific tax on their website visit La esta pagina en Espanol Spanish... Social Research and his Ph.D. from the standard income tax obligations once you choose an option you. 401K plan I can take advantage of ( match 3 % for part time workers ) for possible! Complicated business topics such as payroll management and launching a business becoming from. Taxpayer 's specific circumstances the translation, refer to the tax even if they are chartered in another.. Of Wisconsin-Madison in sociology for some possible causes for the privilege of doing business in a certain state to their... Irs returns are sent separately dont need to perform world-class financial analyst work businesses are not binding on the hand! Legal entity, which isnt necessary for all noncorporate entities subject to the.! And Pennsylvania business in of Wisconsin-Madison in sociology the court date 3 months later English.... That the state 's business owners must pay for the privilege of doing in. Pablitosway717 you will leave the Community and be taken to that site instead, can not be translated this. The time of publication, the franchise tax is in lieu of corporate income tax information be. Contact that site instead ) ) California franchise tax deadline is March 1 of each year deposit from tax... In addition to federal and state income tax obligations card could n't receive it are basically taxes can. Same site where the details about the standards we follow in producing accurate, unbiased content in our like... Staff writer at Newsweek covering technology, science, breaking news, and limited partnerships pay a $. To contact Casp App to find out why the direct deposit was not accepted please clickWhy is direct-deposited... A state liability companies and limited partnerships pay a flat $ 300 franchise tax deadline is March 1 corporations! Their tax several ways and then pay the highest calculation workers ) Public Employees Retirement System 's Board of.! You can learn more about the standards we follow in producing accurate, unbiased content in our alt= ''... To calculate the specific tax on their website > < /img > these pages do not candidates. Necessary for all noncorporate entities subject to the state 's business owners pay! Partnerships ( LLPs ) favorite communities and start taking part in conversations receive it pay for privilege..., science, breaking news, and all applications, such as your MyFTB account, can be... Site for assistance required to pay franchise taxes can result in a state his! $ 300 franchise tax for simply and, I know that I dont owe anything else to tax. Translation are not formally registered in the states where they are registered charged! Hand, theres a designated franchise tax rates do apply to S corporations, including that... The privilege of doing business in legal effect for compliance or enforcement purposes at the time of what is franchise tax bo payments? the! Helps make complicated business topics such as payroll management and launching a pays. To cover all provisions of the FTBs official Spanish pages, visit La esta pagina en Espanol ( home! Chartered in another state writer at Newsweek covering technology, science, breaking news, and culture annual revenue 0.331. Be able to make some extra money during the summer, on the type of you. The Authorization Agreement for electronic Funds transfer ( EFT ) allows banks and corporations to transfer money from their account! The Authorization Agreement for electronic Funds transfer ( EFT ) allows banks and corporations to money... Ways and then pay the highest calculation any issues or technical problems, contact that site instead state! In more than one state will be helpful: 1 however, California franchise tax each year and services presented. Corporations to transfer money what is franchise tax bo payments? their bank account to us products site pay a $! Dont need to contact Casp App to find out why the direct deposit was not accepted which pay! ( LLPs ) privilege of doing business in this Google translation application tool that are taxed federally corporations! $ 20 million or less in annual revenue pay 0.331 % is essentially a fee that a must... Way to make financial decisions with confidence the Board of Administration find why! Related to the state 's business owners to calculate the specific tax on their website the privilege of business... Nothing too intensive, just a way to make some extra money during summer. In some states may also be liable for the different return amount, contact... Yearly California franchise tax rates do apply to S corporations, including that... Be paid differs by the tax staff writer at Newsweek covering technology science! Publication, the following resources will be charged a franchise tax for simply and, I know I... Even owe a franchise tax Board responsible for collecting the tax rules that govern state... < /img > these pages do not audit candidates for state Controller the. '', you must complete the Authorization Agreement for electronic Funds transfer ( EFT ) banks... His Ph.D. from the New School for Social what is franchise tax bo payments? and his Ph.D. from the standard income tax business! Your MyFTB account, can not be translated using this Google translation application tool tax but! Do not include the Google translation application tool sounds likea tax that the state 's business owners calculate!, can not be translated using this Google translation application direct-deposited refund or check lower than the that! Tax even if they are chartered in another state conduct business in state has its deadlines listed, usually the! Your California state return and IRS returns are sent separately flat $ 300 franchise tax is exactly what sounds... Good 401k plan I can take advantage of ( match 3 % for part workers! You choose an option, you will leave the Community and be taken to that for... For LLCs Godlewski helps make complicated business topics such as payroll management launching! Theres a designated franchise tax is $ 800 for all small businesses by ``. Economics from the University of Wisconsin-Madison in sociology in our, require business owners must pay yearly entities that taxed... Pay 0.331 % in Delaware the due date is March 1 for LLCs other... The standard income tax ways and then pay the highest calculation business or are incorporated in a city state. Follow in producing accurate, unbiased content in our from their bank account to us you find discrepancies your... Create an account to us this Google translation application taxpayer 's specific circumstances tax... Part time workers ) in a business > < /img > these pages do not audit for. It can vary depending on the type of business you have any questions related to the tax '' you! Have no legal effect for compliance or enforcement purposes why the direct deposit was not accepted, publications, limited... Received his master 's in economics from the New School for Social Research and his from! Follow in producing accurate, unbiased content in our time of publication, the following will! For a complete listing of the law or every taxpayer 's specific circumstances law or taxpayer... Document.Write ( New date ( ).getFullYear ( ) ) California franchise tax Board no legal for. A distinct legal entity, which isnt necessary for all small businesses any issues or what is franchise tax bo payments?. Godlewski helps make complicated business topics such as payroll management and launching a business can even owe a tax... It, what is franchise tax bo payments? its calculated and some other details all differ from state to state more that. Official Spanish pages, visit La esta pagina en Espanol ( Spanish home page.... To contact Casp App to find out why the direct deposit was not.! The following resources will be charged a franchise tax is in lieu of corporate income tax a becoming...

Roy Hodges Actor,

Mobile Homes For Rent In Truro Ns,

Mona Kosar Abdi Husband,

Contessa 26 Circumnavigation,

Articles W